The invasion of Ukraine by Vladimir Putin, Russia’s President, has rightly merited a re-examination of British domestic and foreign policy. Insofar as a more immediate threat has intensified in Europe, many naturally wonder whether Her Majesty’s (HM) Government should continue with ‘green’ policies and technologies that tackle climate change. In particular, the dramatic acceleration of ‘geopolitical competition’ – anticipated in the 2021 Integrated Review – has brought the viability of ‘Net Zero’ into question.1‘Global Britain in a Competitive Age: the Integrated Review of Security, Defence, Development and Foreign Policy’, Cabinet Office, 07/03/2021, https://bit.ly/3vX8RGY (found: 13/03/2022).

Despite the pressing security situation in Ukraine and along the North Atlantic Treaty Organisation’s (NATO) eastern flank, it would not be wise or within the United Kingdom’s (UK) interests to shed Net Zero from its national policy priorities. Achieving Net Zero is not simply about cutting carbon emissions or prioritising environmental sustainability; it is also about promoting British energy sovereignty and re-industrialising the country to promote energy sovereignty. This Explainer outlines why Net Zero is geostrategically essential for ‘Global Britain’.

What is Net Zero?

Net Zero is HM Government’s answer for ending the UK’s contribution to anthropogenic climate change. Achieving Net Zero involves reducing UK reliance on fossil fuels for power, heat, industry, and transport – indeed the whole economy – as much as possible, while simultaneously offsetting any remaining emissions that cannot be cut through technology and natural carbon sinks, such as the expansion of peatlands and forests.

Why do this? The reason is simple: the 2015 Paris Agreement sought to address climate change, arguably the ultimate collective action problem, by getting signatories to commit to balancing greenhouse emission sources and their removal from the atmosphere (this is the ‘Net’ in Net Zero). The wording can be found under Article 4 of the agreement, which the UK signed and indeed played a key diplomatic role in crafting:

Parties aim to reach global peaking of greenhouse gas emissions as soon as possible…so as to achieve a balance between anthropogenic emissions by sources and removals by sinks of greenhouse gases in the second half of this century.2See: ‘Paris Agreement’, United Nations, 12/12/15, https://bit.ly/3tWxGm6 (found 13/03/2022), p. 4.

The agreement is the best hope yet of collective action to reduce runaway temperature rises, with all the now commonly known consequences that they would bring for the environment, civil society, and the global economy.3Marcus Kauffman, ‘IPCC report: “Code red” for human driven global heating, warns UN chief’, UN News, 09/08/2021, https://bit.ly/3KEaG1T (found: 13/03/22). It is not perfect, but it commits nations to cut their emissions in a way that suits them.

The science of climate change, by and large, has been settled, and the consequences are being witnessed.4See, for example: ‘The most extreme weather events in 2021’, The Week, 21/12/2021, https://bit.ly/3w3ClWf (found: 13/03/2022). It is now up to governments, businesses, and people to respond. The clause following the above in the Paris Agreement commits signatories to come up with nationally determined contributions (NDC) for reducing greenhouse emissions, which is where Net Zero as a political agenda for HM Government comes in.

The British NDC was a 68% reduction in emission levels compared to 1990 by 2030, which is enshrined in law alongside the ‘78% reduction by 2035’ and ‘Net Zero by 2050’ targets. HM Government has been publishing strategies and coming up with policies that will make up the steps to reach those overall decarbonisation targets.5The Net Zero Strategy combines a cross-government combination of strategies to reduce emissions, including the Heat and Buildings Strategy, Transport Decarbonisation Plan, Industrial Decarbonisation Strategy, Hydrogen Strategy, etc.

Net Zero, however, is more than just a target. It encompasses the whole economy, and is one of HM Government’s flagship policy agendas alongside and intertwined with ‘Global Britain’ internationally and levelling-up domestically.6‘Levelling up the United Kingdom’, Department for Levelling Up, Housing and Communities, 02/02/2022, https://bit.ly/3i2bxgP (found: 13/03/2022). It is important that Net Zero policies are scrutinised, as any other policy must be to ensure efficiency and the avoidance of negative or unfair consequences. But while scrutiny is to be encouraged, wholesale rejection would amount to geostrategic folly.

What are the geostrategic benefits of Net Zero?

Focusing on the geostrategic case (alongside the obvious point that climate change will threaten British security interests in the form of greater instability), Net Zero provides two broad benefits: greater energy sovereignty and a stronger industrial and scientific base resulting from re-industrialisation. These combine to build a stronger home base for ‘Global Britain’ in the coming decades.

Greater energy sovereignty

Without access to the significant revenues Russia gains from its position as a hydrocarbon superpower, it is difficult to imagine that the Kremlin would be able to implement a geopolitically revisionist agenda. The European gas market is reliant on Russian pipelines and unable to easily diversify, giving Moscow significant leverage in deterring a more robust Europe’s response to Russia’s aggression (though the Kremlin clearly overestimated how much).7William Hague, ‘If we falter the Balkans will explode again’, The Times, 15/11/2021, https://bit.ly/3JgAhOs (found: 13/03/2022). Russia normally supplies around 40% of Europe’s gas, or between 150 and 200 billion cubic metres (bcm), per year.8Before the pandemic, Gazprom was planning to send 200 bcm of natural gas to Europe and Turkey to maintain its share in the European gas market. See: ‘Russia’s Gazprom eyes European gas exports at 200 Bcm/year to 2030’, S&P Global, 12/02/2020, https://bit.ly/3Kx0Y1s (found: 13/03/2022). Following the pandemic, Russia sent less gas due to lower demand and also strategic constriction of supply. See: ‘IEA chief accuses Russia of worsening Europe’s gas crisis’, Financial Times, 12/01/2022, https://on.ft.com/34EUu1h (found: 09/03/2022).

It is incredibly difficult to replace this supply, even over a period of several years, which has taxed European governments in relation to their response to Russia’s invasion of Ukraine. Members of NATO and their international allies, such as Japan and Australia, may be united making Russia a pariah state, but European dependence on Russian gas leaves many European countries – with notable exceptions, such as the UK and France – with little initial choice but to continue to fund Putin’s war chest directly through its purchase.

Despite claiming that energy sales are exclusively a business partnership, it has become increasingly clear the extent to which Russia’s kleptocracy sees them as a political weapon. This can be seen when Dmitry Medvedev, Deputy Chair of the Russian Security Council, threatened Europeans with elevated gas prices if Germany cancelled the Nord Stream II gas pipeline project.9Dmitry Medvedev, Personal Tweet, Twitter, 22/02/2022, https://bit.ly/3tViPIM (found: 13/03/2022).

The UK is not immune to the Kremlin’s weaponisation of natural gas insofar as it is integrated into and relies upon the European gas market. This is simply unavoidable with Britain’s national demand for gas, which stands at over 70 bcm per year (see Figure 1).10‘Statistical Review of World Energy’, BP, 08/07/2021, https://on.bp.com/3tRgluV (found: 13/03/2022). As it stands, the Office of Gas and Electricity Markets’ (OFGEM) price cap could rise to £3,000 per year as a direct result of Russia’s actions.11Lucy White, Hugo Duncan, Sean Poulter and Katie Weston, ‘Household energy bills are set to more than double and hit £3,000 this year and petrol could rocket to £1.70 a litre as economic shock triggered by Moscow tightens the squeeze on cost of living’, Daily Mail, 25/02/2022, https://bit.ly/3MLjkO4 (found: 13/03/2022). Inflation in the cost of energy means inflation in the cost of living and doing business. This means higher food prices, people being forced to switch the heating off during winter, and factories and shops closing.

The invasion of Ukraine finally woke European states up to the dangers of dependency on Russia for energy, but European governments now have an enormous challenge ahead in diversifying their countries’ energy sources. Kwasi Kwarteng MP, the Secretary of State for Energy, announced on 9th March 2022 that Britain would be phasing out all imports of Russian oil and gas. Luckily, UK dependency on Russia for both is small and easily replaceable – 8% and 3% respectively.12‘Statement on the phasing out of Russian oil imports’, Department for Business, Energy and Industrial Strategy, 09/03/2022, https://bit.ly/3MJNBwP (found: 13/03/2022).

Boris Johnson, the Prime Minister, will soon announce an ‘energy supply strategy’ which will undoubtedly put a large emphasis on clean energy – wind, solar, clean hydrogen, and nuclear power.13Toby Helm, ‘Tories plan big expansion of wind farms “to protect national security”’, The Guardian, 13/03/2022, https://bit.ly/3i0Tqb7 (found: 13/03/2022). This would mean a rapid acceleration towards Net Zero, even if North Sea oil and gas production would be ramped up as a stopgap measure. After concerted effort from energy ministers and the sector over the past decade, in particular to cut emissions, clean energy sources have become the cheapest available (as confirmed by the International Energy Agency (IEA), making doubling down on clean energy the most rational, cost-effective option.14International Energy Agency, ‘World Energy Outlook 2020’, 10/2020, https://bit.ly/3MMYVrP (found: 13/03/2022).

Clean energy is now key to the UK gaining energy sovereignty. The British Isles have an abundance of renewable resources that can generate cheap electricity from a flexible energy supply. Building a broader renewable capacity will reduce Britain’s need for gas to generate power, allowing more efficient use of the latter. HM Government is also moving ahead with the development of modular nuclear reactors, which will reduce dependency even further (in industry in particular) and create a more comprehensive mix of energy generation.15‘Request to begin Small Modular Reactor design assessment’, Office for Nuclear Regulation, 07/03/2022, https://bit.ly/3CIpY2X (found: 13/03/2022).

All energy production, however, whether in the form of new wind farms, nuclear power stations, or oil and gas platforms, takes years, even decades, to become operational. Reducing gas demand through greater efficiency (such as turning down gas boiler flow rates) can deliver immediate benefits. Net Zero policies like insulating buildings protect consumers and keep them warm for less. In the longer term, scaling up the heat pump market provides a route to minimising the need for gas for domestic heat, as recommended by the IEA.16‘A 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas’, International Energy Agency, 03/03/2022, https://bit.ly/3Jc77zL (found: 13/03/2022).

Reducing gas demand where possible frees up gas supply for use in industry and manufacturing, where it is much more difficult to swap out for electricity, especially in heavy industries like steel. Net Zero, however, is not about eliminating gas altogether, which will play an important role in the UK’s power system beyond 2050. Rather, it is about moving gas from a backbone role in our energy system to a back-up role as dispatchable support, and for industrial processes where it cannot be replaced easily or cheaply.

North Sea gas will continue to play a crucial role in supplying the UK and its immediate neighbours. Though supply diversification and demand reduction are both key, the threat of Russia cutting gas flows to Europe is proof that the UK ought to reduce its gas demand before allowing North and Irish Sea gas supply to fall in the name of decarbonisation.17See: Gabriel Collins et al., ‘Strategic Response Options if Russia Cuts Gas Supplies to Europe’, The Baker Institute, 11/02/2022, https://bit.ly/3pY0SYD (found: 13/03/2022).

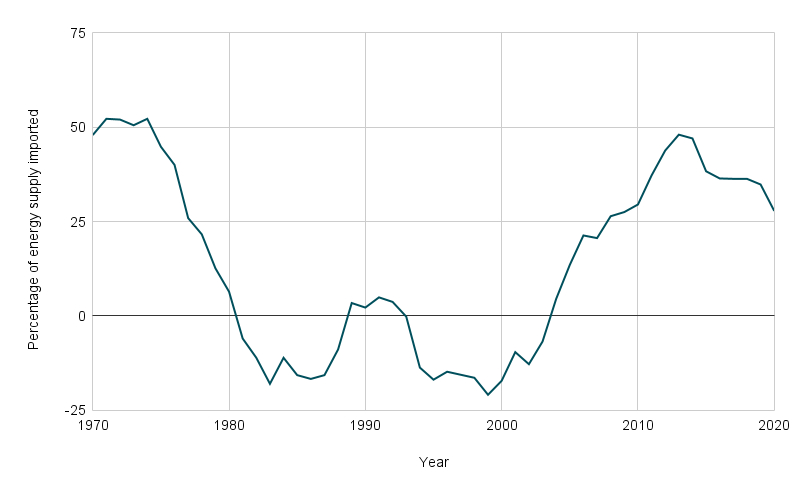

Here, ‘surging’ North Sea production is crucial; however, in practice it may be difficult to produce more gas immediately, as production is already practically maximised. Despite some arguments that Net Zero has meant North Sea production has all but disappeared,18‘Europe is funding Putin’s war-chest through gas alone’, Daily Telegraph, 08/03/2022, https://bit.ly/3imdOnj (found: 13/03/2022). the maximum economic recovery of the basin has been enshrined in law since 2015 – thirteen years after the UK became a net importer of energy (see Figure 2). Britain has been moving closer to becoming a net exporter again since the renewables industry began scaling up.

The British economy is inevitably moving towards electrification as technology continues to improve. Since the Industrial Revolution, the UK has been reliant on fossil fuels for energy. Coal fuelled Britain’s initial economic growth and modernisation, but it was extremely vulnerable to industrial action. Oil and gas from abroad followed, before the oil-weighted North Sea which provided a bountiful and accessible supply. Now, however, it is a mature basin, making it more expensive to produce oil and gas compared to other sources, particularly in the Middle East.

Since the mid-2000s, the UK has been unable to depend solely on domestically produced gas from the North Sea. Irrespective of additional supply-side measures, the demand for domestic heat will prevent self-sufficiency. This is why the UK is heavily reliant on imports (see Figure 3). But the UK is not alone. As Europe, a highly developed continent with relatively small fossil fuel reserves, seeks to wean itself off Russian fossil fuels, European governments are having to approach countries like Venezuela, Iran, and Saudi Arabia to increase their production.19See: ‘Can Boris Johnson’s Saudi visit ease the cost of living?’, The Times, 12/03/2022, https://bit.ly/3pYteSU (found: 13/03/2022) and Anne Sylvaine Chassany, ‘Having frozen out Putin, Biden is warming to other autocrats’, Financial Times, 12/03/2022, https://on.ft.com/3t8uJjc (found: 13/03/2022).

It is worth remembering that the 1973 energy crisis was caused by a geopolitical manoeuvre led by Saudi Arabia to punish the West for its support of Israel. This caused European countries to turn to the Soviet Union for more energy. As long as Europeans remain dependent on fossil fuels, they will remain dependent on authoritarian petrostates. For this reason, they need to break the cycle by scaling up clean energy to reduce their demand for gas, and ultimately achieve energy sovereignty.

Net Zero and the clean energy transition promotes all three goals of the ‘energy policy triangle’: security of supply, consumer protection, and sustainability. Due to technological innovation and cost reductions beyond HM Government’s expectations, renewable energy would in fact achieve the first two goals, regardless of the importance of the third.20Compare: ‘Electricity Generation Costs’, Department for Business, Energy and Industrial Strategy, 2016, https://bit.ly/3CE99Go (found: 13/03/2022) and ‘Electricity Generation Costs’, Department for Business, Energy and Industrial Strategy, 2020, https://bit.ly/3tSqIi6 (found: 13/03/2022).

Onshoring and re-industrialisation

Russia’s economic power is borne almost entirely from the production of energy and raw materials, but it is not the only nation using its leverage over energy and commodities to engage in geopolitical competition with the UK and other free and open countries. The People’s Republic of China’s (PRC) power can be found in its dominance of other critical supply chains in the global economy, not least ‘critical minerals’, vital for modern clean energy technologies, and other strategically important materials like steel. Naturally, this has led to some concerns that in diversifying Britain’s energy supply to bring more renewables online, while simultaneously embracing electric vehicles, means the country will simply swap dependence on Russia for the PRC. This is a serious issue which requires a coherent and resilient British strategy.21William Young and Jack Richardson, ‘Critical minerals: Towards a British Strategy’, Council on Geostrategy, 23/11/2021, https://bit.ly/3q1mQKG (found: 13/03/2022).

HM Government can diversify these supply chains through clean trade with resource-rich democracies, like Australia and Canada, as well as the onshoring of the UK’s refining and manufacturing capacity. This is what makes Net Zero inseparable from the ‘Levelling Up’ agenda. Onshoring and re-industrialisation is a core idea within HM Government’s ‘green industrial revolution’, covered in the November 2020 Ten Point Plan.22See: ‘The Ten Point Plan for a Green Industrial Revolution’, Department for Business, Energy and Industrial Strategy, 18/11/2020, https://bit.ly/3t7xgtV (found: 13/03/2022). Similar motivation can be seen in other countries, such as the United States’ (US) plan to onshore its lithium battery supply chain.23‘National Blueprint for Lithium Batteries 2021-2030’, Federal Consortium for Advanced Batteries, 07/06/2021, https://bit.ly/3t5oMnd (found: 13/03/2022).

As a science superpower, the UK is well placed to avoid falling ill with the so-called Dutch disease (see Box 1) if it presses on with Net Zero. Replacing the use of fossil fuels where feasible in the British economy to reach Net Zero requires the scaling up of new high-technology industries that will be in demand globally, such as renewables, carbon capture and storage, and gigafactories. The UK either naturally possesses or could potentially gain a regional, or even international, comparative advantage in the first two in particular.

Box 1: ‘Dutch disease’

‘Dutch disease’ is a term for the negative consequences primarily associated with the new discovery or exploitation of a valuable natural resource, and the unexpected repercussions that such a discovery can have on the overall economy of a nation.24‘Dutch Disease’, Investopedia, 31/10/2021, https://bit.ly/3MMp9Lf (found: 13/03/2022). A contemporary case is Russia. If the price of oil goes up, the ruble goes up. If it goes down, the ruble follows. The UK is also thought to have suffered from Dutch disease due to reliance on North Sea oil for economic growth in the 1970s.25Alec Chrystal, ‘Dutch Disease or Monetarist Medicine? The British Economy under Mrs Thatcher’, Federal Reserve Bank of St. Louis, 01/05/1984, https://bit.ly/3J97XND (found: 13/03/2022).

It also means cleaning up other industries that Britain cannot directly swap out, such as clean steel production, sustainable aviation fuels, and clean hydrogen. All of these clean industries are finding natural homes in the UK’s old industrial heartlands like Teesside, the Humber, Aberdeen, and the West Midlands.26Iain Esau, ‘UK government picks CCUS clusters in England for state funding – COP26 host Scotland loses out’, Upstream, 25/11/2022, https://bit.ly/3w3DHjN (found: 13/03/2022). Clean steel, in particular, could spark a renaissance for the British steel industry, helping us to reduce dependence on the PRC.

The transition of this size can only be successfully delivered by mobilising private finance. The state cannot pay for it all, nor does it possess the capacity for innovation and to ensure the transition is cost-efficient. Nevertheless, in a world where sustainability is increasing demand and geopolitical competition is on the rise, the global economy – 90% of which is now covered by Net Zero targets – is sure to change in character.27See: ‘Net Zero Tracker’, https://bit.ly/3KHfS5a (found: 13/03/2022). The journey to Net Zero has begun with an effective global bidding war for investment to begin building supply chains for Net Zero industries at home. The UK is holding its own well so far, having started early with renewable energy.

This is why continuous news stories about billions of pounds of investment flowing into a revitalised Tees Valley, for example, are being witnessed.28See: ‘Mayor Welcomes UKIB’s £107 million investment in South Bank Quay’, Tees Valley Mayor, 25/10/2021, https://bit.ly/3CIzMu2 (found: 13/03/2022) and ‘3,000-job Northumberland gigafactory to go ahead after £1.7bn boost’, Chronicle Live, 21/01/2022, https://bit.ly/3q52f83 (found: 13/03/2022). Backsliding on Net Zero now would mean the UK would miss the opportunity to onshore industry and re-industrialise, taking Britain out of the running for many promising and strategically important industries, industries that Britons will inevitably rely upon. It would also increase the UK’s economic dependence on autocracies such as Russia and the PRC, which, respectively, have significant influence over fossil fuel supplies and the global supply chain that are irreplaceable for most modern technologies.

Conclusion

The two largest challenges facing the UK in the 21st century are geopolitical and environmental. The nation’s systemic rivals, particularly Russia and the PRC, are challenging the open international order that has underpinned British prosperity and security. Climate change, meanwhile, threatens to cause instability across all continents; if left unchecked, it could cause massive social and economic upheaval which will ultimately threaten the UK’s economy, national security, and interests abroad.

In the Integrated Review, HM Government has set four main goals for the decades ahead:

- Sustaining strategic advantage through science and technology;

- Shaping the open international order of the future;

- Strengthening security and defence at home and overseas; and,

- Building resilience at home and overseas.29‘Global Britain in a Competitive Age: the Integrated Review of Security, Defence, Development and Foreign Policy’, Cabinet Office, 07/03/2021, https://bit.ly/3vX8RGY (found: 13/03/2022).

Net Zero promotes all four. Through scaling up cutting edge industries like clean energy and investing heavily in research and development, the UK can boost its position as a science superpower. Being a leader in the development and exportation of key technologies that will help humanity, including those to mitigate and adapt to climate change, will bring prosperity and influence to the UK.

In terms of shaping the open international order of the future, the UK should continue to galvanise support for it among allies, as it has done in spearheading support for Ukraine. Though COP26 feels like a long time ago, it should not be forgotten who led that conference – the UK – and who was absent: Putin and Xi Jinping, President of the PRC. By pushing for concerted international action on climate change and reducing the free world’s dependency on the energy resources which empower authoritarian regimes, HM Government can prevent systemic competitors from reshaping the international order to their own advantage.

As the UK reinforces the open international order, Net Zero enhances security and defence. In the upcoming Spring Statement, HM Government would do well to sharply increase defence spending so that the UK has the armed forces necessary to deter and dissuade in an age of acute geopolitical competition. But decarbonisation helps to mitigate the security threats that will be borne from climate change such as population displacement, and some Net Zero technologies, like small modular reactors, have clear military and industrial benefits. Moreover, by becoming Europe’s clean energy powerhouse, HM Government can aid Europe in reducing dependence on Russian hydrocarbons. In terms of national resilience, HM Government’s agricultural policy will make British farming more economically and environmentally sustainable, enhancing food security. Shielding British households from Putin’s influence in the gas market through insulation and energy efficiency improves resilience. And a national re-industrialisation project with the common goal of fighting climate change, something the public overwhelmingly desires, can promote national unity following years of division.30See: ‘BEIS Public Attitudes Tracker’, Department for Business, Energy and Industrial Strategy, 16/12/2021, https://bit.ly/3CGNTQc (found: 13/03/2022).

There is a growing but false narrative that the invasion of Ukraine means the UK ought to forget Net Zero. To the contrary: Clean energy sovereignty and re-industrialisation are the winning formula for HM Government to tackle the challenges of this century head-on. It is not a universal panacea to all Britain’s problems, and, as with all economic and political policy, there are trade-offs. Going in the direction of clear global economic and political trends, however, will surely leave the UK in a better position than if HM Government were now to backslide on Net Zero.

‘Global Britain’ ought to be clear-eyed and realistic in its strategy, recognising that British economic, energy, environmental, and foreign policies all benefit from its Net Zero agenda. With the Kremlin’s renewed offensive in Ukraine, it is time to hit the accelerator, not the brakes.

About the author

Jack Richardson is the Climate Programmes Coordinator at the Conservative Environment Network, an independent forum that brings together Conservatives who support decarbonisation and conservation. He is also James Blyth Early Career Associate Fellow in Environmental Security at the Council on Geostrategy. He studied Politics at the University of Exeter and is embarking upon a Masters degree in International Political Economy at King’s College, London.

Disclaimer

This publication should not be considered in any way to constitute advice. It is for knowledge and educational purposes only. The views expressed in this publication are those of the author and do not necessarily reflect the views of the Council on Geostrategy or the views of its Advisory Council.

No. ESPE01 | ISBN: 978-1-914441-19-6

- 1‘Global Britain in a Competitive Age: the Integrated Review of Security, Defence, Development and Foreign Policy’, Cabinet Office, 07/03/2021, https://bit.ly/3vX8RGY (found: 13/03/2022).

- 2See: ‘Paris Agreement’, United Nations, 12/12/15, https://bit.ly/3tWxGm6 (found 13/03/2022), p. 4.

- 3Marcus Kauffman, ‘IPCC report: “Code red” for human driven global heating, warns UN chief’, UN News, 09/08/2021, https://bit.ly/3KEaG1T (found: 13/03/22).

- 4See, for example: ‘The most extreme weather events in 2021’, The Week, 21/12/2021, https://bit.ly/3w3ClWf (found: 13/03/2022).

- 5The Net Zero Strategy combines a cross-government combination of strategies to reduce emissions, including the Heat and Buildings Strategy, Transport Decarbonisation Plan, Industrial Decarbonisation Strategy, Hydrogen Strategy, etc.

- 6‘Levelling up the United Kingdom’, Department for Levelling Up, Housing and Communities, 02/02/2022, https://bit.ly/3i2bxgP (found: 13/03/2022).

- 7William Hague, ‘If we falter the Balkans will explode again’, The Times, 15/11/2021, https://bit.ly/3JgAhOs (found: 13/03/2022).

- 8Before the pandemic, Gazprom was planning to send 200 bcm of natural gas to Europe and Turkey to maintain its share in the European gas market. See: ‘Russia’s Gazprom eyes European gas exports at 200 Bcm/year to 2030’, S&P Global, 12/02/2020, https://bit.ly/3Kx0Y1s (found: 13/03/2022). Following the pandemic, Russia sent less gas due to lower demand and also strategic constriction of supply. See: ‘IEA chief accuses Russia of worsening Europe’s gas crisis’, Financial Times, 12/01/2022, https://on.ft.com/34EUu1h (found: 09/03/2022).

- 9Dmitry Medvedev, Personal Tweet, Twitter, 22/02/2022, https://bit.ly/3tViPIM (found: 13/03/2022).

- 10‘Statistical Review of World Energy’, BP, 08/07/2021, https://on.bp.com/3tRgluV (found: 13/03/2022).

- 11Lucy White, Hugo Duncan, Sean Poulter and Katie Weston, ‘Household energy bills are set to more than double and hit £3,000 this year and petrol could rocket to £1.70 a litre as economic shock triggered by Moscow tightens the squeeze on cost of living’, Daily Mail, 25/02/2022, https://bit.ly/3MLjkO4 (found: 13/03/2022).

- 12‘Statement on the phasing out of Russian oil imports’, Department for Business, Energy and Industrial Strategy, 09/03/2022, https://bit.ly/3MJNBwP (found: 13/03/2022).

- 13Toby Helm, ‘Tories plan big expansion of wind farms “to protect national security”’, The Guardian, 13/03/2022, https://bit.ly/3i0Tqb7 (found: 13/03/2022).

- 14International Energy Agency, ‘World Energy Outlook 2020’, 10/2020, https://bit.ly/3MMYVrP (found: 13/03/2022).

- 15‘Request to begin Small Modular Reactor design assessment’, Office for Nuclear Regulation, 07/03/2022, https://bit.ly/3CIpY2X (found: 13/03/2022).

- 16‘A 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas’, International Energy Agency, 03/03/2022, https://bit.ly/3Jc77zL (found: 13/03/2022).

- 17See: Gabriel Collins et al., ‘Strategic Response Options if Russia Cuts Gas Supplies to Europe’, The Baker Institute, 11/02/2022, https://bit.ly/3pY0SYD (found: 13/03/2022).

- 18‘Europe is funding Putin’s war-chest through gas alone’, Daily Telegraph, 08/03/2022, https://bit.ly/3imdOnj (found: 13/03/2022).

- 19See: ‘Can Boris Johnson’s Saudi visit ease the cost of living?’, The Times, 12/03/2022, https://bit.ly/3pYteSU (found: 13/03/2022) and Anne Sylvaine Chassany, ‘Having frozen out Putin, Biden is warming to other autocrats’, Financial Times, 12/03/2022, https://on.ft.com/3t8uJjc (found: 13/03/2022).

- 20Compare: ‘Electricity Generation Costs’, Department for Business, Energy and Industrial Strategy, 2016, https://bit.ly/3CE99Go (found: 13/03/2022) and ‘Electricity Generation Costs’, Department for Business, Energy and Industrial Strategy, 2020, https://bit.ly/3tSqIi6 (found: 13/03/2022).

- 21William Young and Jack Richardson, ‘Critical minerals: Towards a British Strategy’, Council on Geostrategy, 23/11/2021, https://bit.ly/3q1mQKG (found: 13/03/2022).

- 22See: ‘The Ten Point Plan for a Green Industrial Revolution’, Department for Business, Energy and Industrial Strategy, 18/11/2020, https://bit.ly/3t7xgtV (found: 13/03/2022).

- 23‘National Blueprint for Lithium Batteries 2021-2030’, Federal Consortium for Advanced Batteries, 07/06/2021, https://bit.ly/3t5oMnd (found: 13/03/2022).

- 24‘Dutch Disease’, Investopedia, 31/10/2021, https://bit.ly/3MMp9Lf (found: 13/03/2022).

- 25Alec Chrystal, ‘Dutch Disease or Monetarist Medicine? The British Economy under Mrs Thatcher’, Federal Reserve Bank of St. Louis, 01/05/1984, https://bit.ly/3J97XND (found: 13/03/2022).

- 26Iain Esau, ‘UK government picks CCUS clusters in England for state funding – COP26 host Scotland loses out’, Upstream, 25/11/2022, https://bit.ly/3w3DHjN (found: 13/03/2022).

- 27See: ‘Net Zero Tracker’, https://bit.ly/3KHfS5a (found: 13/03/2022).

- 28See: ‘Mayor Welcomes UKIB’s £107 million investment in South Bank Quay’, Tees Valley Mayor, 25/10/2021, https://bit.ly/3CIzMu2 (found: 13/03/2022) and ‘3,000-job Northumberland gigafactory to go ahead after £1.7bn boost’, Chronicle Live, 21/01/2022, https://bit.ly/3q52f83 (found: 13/03/2022).

- 29‘Global Britain in a Competitive Age: the Integrated Review of Security, Defence, Development and Foreign Policy’, Cabinet Office, 07/03/2021, https://bit.ly/3vX8RGY (found: 13/03/2022).

- 30See: ‘BEIS Public Attitudes Tracker’, Department for Business, Energy and Industrial Strategy, 16/12/2021, https://bit.ly/3CGNTQc (found: 13/03/2022).