Foreword

The United Kingdom (UK) is stepping up to Net Zero. We are seizing it as the opportunity for levelling up the country through new technologies which will improve the standard of living for all. We have set out our ambitious Net Zero Strategy, which includes world-leading targets for emission reductions and scaling up the next generation of green technologies: we will capture the infinite energy of the wind and sun to power our cars, heat our homes, and build industry.

Now that the UK has successfully led the world to the Glasgow Climate Pact, we must now get on with leading in delivery. We are levelling up the economy through the Green Industrial Revolution; through our Ten Point Plan we have already attracted over £5.8 billion of new inward investment. We will continue on to create and support hundreds of thousands of new high skilled, high wage green jobs over the next decade.

The global energy transition away from fossil fuels is already well underway. We are in the springtime of renewables, which are now delivering the cheapest energy available, while the electric vehicle market is scaling up at an astonishing rate. Though these technologies are more sustainable for the planet, the ingredients to manufacture them are different, and pose new economic, social, and environmental challenges in sourcing them.

According to the International Energy Agency’s most recent World Energy Outlook, reaching our 1.5°c target under the Paris Agreement will mean a sixfold increase in demand for critical minerals like lithium, cobalt, and rare earth minerals. This represents a tremendous opportunity for basing more supply chains in the UK and stimulating more trade with allies and friends like Australia, Canada, the United States and Vietnam, but also significant risk to our industry and economy if we allow them to remain under the control of systemic competitors.

As a member of the All Party Parliamentary Group on Critical Minerals, I have been campaigning for the development of UK critical mineral policy. These are the ingredients for the green industrial revolution which will be key to unlocking prosperity across the UK, including in constituencies like Rother Valley, where I represent. I was very pleased to see the Government commit to publishing a Critical Minerals Strategy next year in the Net Zero Strategy.

We need fresh thinking if we are to meet these unprecedented challenges, which this report from the Council on Geostrategy delivers. It is a welcome contribution to the debate over how we secure our supply of these minerals for the Net Zero transition ahead of our Critical Minerals Strategy next year, where Her Majesty’s Government will be laying out how it will mitigate the risks to critical Net Zero supply chains.

– Alexander Stafford MP

Member of Parliament for Rother Valley

Member, All Party Parliamentary Group on Critical Minerals

Executive summary

- In late 2010, a Chinese fishing trawler collided with two separate Japanese Coast Guard ships. The captain was detained by the Japanese authorities. In response, the People’s Republic of China (PRC) cut export quotas of rare earth elements (rare earths) by 40%. The global price for rare earths quadrupled, drawing attention to the PRC’s dominance over the supply chains of many of the world’s critical minerals which had been built over the previous decades, and in the case of the production of rare earths reached 97%.

- In the months and years that followed Japan, South Korea, the United States (US) and the United Kingdom (UK) examined their reliance on PRC. The US Department of Defence invested in rare earth stockpiles and mining facilities, as have Japan and South Korea. Consequently, although the PRC continues to dominate rare earths separation and refining with a 90% market share, mining is now more diversified with 58% in the PRC and the remainder in the US, Myanmar and Australia. The most exposed countries now typically have stockpiles of 50-100 days.

- Since the UK became the first major economy to commit to a Net Zero target in 2019, concerns have increased that the transition to electric vehicles, wind farms and other advanced technology would leave the country exposed to Chinese-dominated supply chains, just as demand for these critical minerals increased sixfold.

- The risks spelled out in Her Majesty’s (HM) Government’s Integrated Review in March 2021 included increased competition for scarce natural resources, such as critical minerals, including rare earths. The review also stated that control of supply may be used as leverage on other issues. In its October 2021 Net Zero Strategy, HM Government committed to addressing this by forming a Critical Minerals Expert Committee (CMEC), setting up a Critical Minerals Intelligence Centre, and by publishing a Critical Minerals Strategy in 2022.

- This Policy Paper recommends an approach which addresses both the need to ensure ‘resilience’ and the opportunity to capture ‘growth’ in critical mineral supply chains.

- Fundamentally this is about co-opting appropriate expertise to the CMEC and Intelligence Centre, commissioning these and other experts to detail the current structure of the industry and cost breakdown for the production of critical raw materials, and identify scenarios in which non-Chinese supply of rare earths and permanent magnets could compete. Finally, HM Government ought to develop, iterate and align these and the resulting industry and policy recommendations to build industry confidence in its own ability to become self-sufficient.

1.0 Introduction

There is no shortage of resources worldwide, and there are sizeable opportunities for those who can produce minerals in a sustainable and responsible manner.1Fatih Birol, Executive Director of the International Energy Agency (IEA), quoted in: ‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021).

In late 2010, a Chinese fishing trawler captain who had tried to fish in waters controlled by Japan collided with two separate Japanese Coast Guard ships, before being detained by the Japanese authorities. Shortly thereafter, the People’s Republic of China (PRC) cut rare earth elements (rare earths)2To assist the reader, certain terms and concepts are highlighted in bold on first mention. These terms and concepts are explained in Appendix I. export quotas to Japan by 40%, with many believing that this was being done to put political pressure on the Japanese. This led global prices for rare earths to quadruple, drawing attention to Chinese dominance (97%) of rare earths production.3Julieanna Powell-Turner and Peter D. Antill, ‘Critical Raw Materials and UK Defence Acquisition: The Case of the Rare Earth Elements’, Kevin Burgess and Peter Antill (eds.), Emerging Strategies in Defence Acquisitions and Military Procurement (Hershey, Pennsylvania: IGI Global, 2016).

The PRC’s apparent willingness to use this dominance as leverage in international disputes provoked a wave of examination in Japan, the United States (US) and the United Kingdom (UK).4Richard Silberglitt et al., ‘Critical Materials: Present Danger to US Manufacturing’, RAND Corporation, 2013, https://bit.ly/3DIJkF0 (found: 21/11/2021). Off the back of this the US Department of Defence invested in rare earths stockpiles and later mining facilities. Japan and South Korea later did the same though at a smaller scale. Consequently, although the PRC continues to dominate rare earths separation and refining with a 90% market share, mining is now more diversified with 58% in the PRC and the remainder in the US, Myanmar and Australia.5‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021), p. 153. The most exposed countries now typically have stockpiles of 50-100 days. However, as the International Energy Agency (IEA), in a comprehensive study on the subject completed in 2021, stated: ‘There is no shortage of resources worldwide, and there are sizable opportunities for those who can produce minerals in a sustainable and responsible manner.’6Birol, quoted in: ‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021). These include, specifically, Cobalt, Copper, Lithium, Nickel and rare earths (Neodymium, Dysprosium, Praseodymium, Terbium, and others).7Ibid.

Through the Critical Minerals Expert Committee (CMEC), Intelligence Centre, and the upcoming Critical Minerals Strategy due to be published next year, Her Majesty’s (HM) Government can effectively assess and take steps to reduce supply chain risk exposure and capture opportunity as it adapts to a ‘more competitive and fluid international environment’.8‘Global Britain in a Competitive Age: The Integrated Review of Security, Defence, Development and Foreign Policy’, Cabinet Office, 07/03/2021, https://bit.ly/3vX8RGY (found: 21/11/2021). To do so it should:

- Recruit the appropriate expertise to the CMEC to address both resilience and growth opportunities;

- Commission these and other experts to detail the current structure of the industry and cost breakdown for the production of key end products such as permanent magnets;

- Identify scenarios in which non-Chinese supply of rare earths and permanent magnets could compete, in terms of quality, cost and environmental standards, with existing PRC-located supply and consult industry on the steps that would be needed to achieve this;

- Develop, iterate and align these and the resulting industry and policy recommendations through the institution of the Intelligence Centre.

The reduction in supply risk and the potential development of domestic industry as well as the concomitant benefits to the financial and services sector, would require:

- A clear and credible vision for the competitive production of batteries and permanent magnets in the UK for domestic use and for export;

- Increased production of non-Chinese controlled rare earth oxides and cobalt;

- Targeted measures by HM Government including but not limited to tariff cuts on raw material imports, collaboration with Japanese, US, Canadian and Australian governments and industrial firms on foreign direct investment, support to British small and medium enterprises (SMEs) to establish UK processing sites and overseas mining, and direction to the UK’s scientific, research and innovation community to develop cleaner and more competitiveness production processes;

- Industry confidence in the commitment of HM Government to targeted support of the industry until it has become self sufficient.

If HM Government is able to take steps in this direction it would enable progress on four issues:

- The decrease in vulnerability to the PRC and other countries’ dominance in key points of the supply chain;

- The expansion of manufacturing in the UK to support the levelling-up agenda;

- The alignment of nations such as Japan, South Korea, Canada, Australia, Indonesia and others behind the opportunities of the Net Zero agenda, the green industrial revolution and benefits of fair, clean trade between free and open nations;

- The reduction in exposure of the London Stock Exchange to – and by extension British pensioners’ dependence on – environmentally damaging production processes for rare earths and coal mining, and the further development of the UK as a centre of mining financing and research.

This paper gives an outline of the UK’s official position on critical materials and the steps taken to date by other free and open nations. It then shows the progress that has been since the crisis in 2010, the clear opportunity inherent in the green industrial revolution and the remaining supply challenges. It then puts forward policy recommendations in the form of key expertise which HM Government should draw on in the coming months to inform its strategy and the issues it may wish to examine. These are anchored in two aligned areas – resilience and growth. Finally, via detailed appendices, the paper summarises key materials as well as the approaches being taken by other countries and trade blocs.

2.0 The UK’s official position

Since 2010, the British policymaking community has been aware of the potential risks inherent in the PRC’s near dominance of rare earths mining and refining. It has also acknowledged that the shift towards electric vehicles and wind turbines would increase this exposure as well as accentuating other risks such as the concentration of cobalt supply from the Democratic Republic of Congo (DRC). The risks spelled out in the March 2021 Integrated Review included ‘increased competition for scarce natural resources such as critical minerals, including rare earth elements, and [that] control of supply may be used as leverage on other issues’.9‘Global Britain in a Competitive Age: The Integrated Review of Security, Defence, Development and Foreign Policy’, Cabinet Office, 07/03/2021, https://bit.ly/3vX8RGY (found: 21/11/2021). In its October 2021 Net Zero Strategy, HM Government committed to addressing this by forming an Expert Committee on Critical Minerals, a Critical Minerals Intelligence Centre, and to publishing a Critical Minerals Strategy in 2022.10‘Net Zero Strategy: Build Back Greener’, HM Government, 10/2021, https://bit.ly/3l0yFhp (found: 21/11/2021), p. 237.

For further detail on the development of UK critical mineral policy, see Appendix III.3.

2.1 Position of other free and open nations

The UK is not alone in addressing this challenge. The US Department of Defence and US Department of State have, through multiple administrations, moved from observation (2010), to proactive stockpiling (2014) to direct investment in production facilities (2018) for rare earths, and stimulating domestic demand to boost domestic supply (2021). In 2012, Japan published a strategy for resource securement including active purchasing and investment by the Japan Oil, Gas and Metals National Corporation (JOGMEC) and in 2020 confirmed it would stockpile materials and support firms to obtain stakes in resources overseas.11Julian Ryall, ‘Japan moves to secure rare earths to reduce dependence on China’, South China Morning Post, 17/08/2020, https://bit.ly/30JTdEh (found: 21/11/2021). South Korea, having established a research partnership with the Ames National Laboratory of the US Department of Energy in 2011, established a policy of stockpiling and in August 2021 announced that this would be increased from 57 to 100 days of demand.12Kim Byung-wook, ‘S. Korea to beef up critical metals stockpile’, The Korea Herald, 05/08/2021, https://bit.ly/3CT75ZT (found: 21/11/2021). Australia and Canada have published critical minerals strategies which are less about securing supply and more about developing the extensive opportunities for mining and refining in each country. And at the behest of national governments, the European Union (EU) has also published a critical raw materials list and launched a Raw Materials Alliance to examine and develop investment opportunities to secure supply of rare earths and in particular material for permanent magnets used in electric vehicles and wind turbines.

In developing these strategies the unique circumstances of each country and jurisdiction – both in terms of demand and supply – result in a wide range of minerals or raw materials being identified as critical. In the strategies named above between 19 and 36 items are typically specified with the 17 rare earths often counted as one or two items. Materials as varied as aluminum/bauxite/aluminium (US) and nickel (South Korea) are included. Only a small portion of these are directly linked to environmental products such as electric vehicles or wind turbines, and some are clearly mis-aligned to the environmental agenda such as the EU’s listing of coking coal.

For further detail on the development of other countries’ critical mineral policies, see Appendix III.

3.0 Progress, challenges, and opportunities

The situation in 2021 is different to 2010 in two primary ways. First, the production of rare earths is now more geographically diverse. The second is that the investment opportunities in the transition to a clean economy are far clearer. However, the midstream processing of rare earths and the production of permanent magnets remains concentrated in the PRC. This dependence is mirrored in other critical minerals such as cobalt where the DRC has a dominant share.13‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021).

The production of rare earths is now more geographically diverse with the PRC’s share declining from 97% in 2010 to 58% in 2020 (see Graph 1). The number of countries producing rare earth oxides has also increased from four to 11 countries. This is a result of US efforts to expand non-Chinese production with investments in the US, Australia and elsewhere and concurrent Chinese efforts to expand production capacity overseas.

Graph 1: Rare earths production 2009-2020 (% of global production)14‘Rare Earths Statistics and Information’, US Geological Survey, No date, https://on.doi.gov/3DEjyBH (found: 21/11/2021).

The investment opportunities in the transition to a clean economy are far clearer with 89% of global emissions covered by a Net Zero target.15‘BNEF Takes on COP26: Day 1-3 Highlights’, BloombergNEF, 02/11/2021, https://bit.ly/3r2syx6 (found: 13/11/2021). The additional commitments by Australia, India, Indonesia, Thailand, Vietnam, to Net Zero at the United Nations Climate Change Conference (COP26) in Glasgow has given a strong signal to both the developed and developing world that the transition is likely and in time frames that are increasingly relevant to investors.

The demand for clean energy transition minerals (rare earths, copper, lithium and others) is expected to grow threefold from less than US$50 billion to approximately US$150 billion in the next ten years (see Graph 2) – very much in investors’ time horizons. In 2040, the commercial revenue of US$250 billion per annum from these minerals is expected to exceed the US$180 billion per annum from coal production. Of this demand for neodymium – one of the main rare earths – is expected to increase four fold.16‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021).

Graph 2: Revenue from production of coal and energy transition minerals in the IEA’s Sustainability Development Scenario (US$ billion)17‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021).

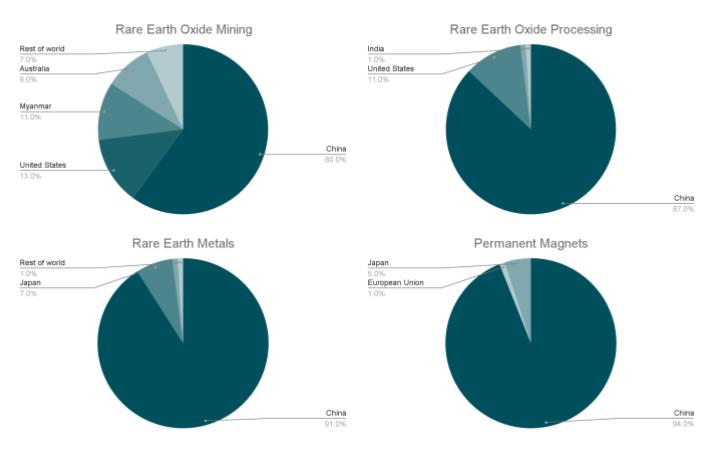

The midstream processing of rare earths and the production of manufactured goods such as permanent magnets remains concentrated in the PRC with 87%-91% and 94% market shares, respectively (see Graph 3).18‘Rare Earth Magnets and Motors’, EIT Raw Materials, 2021, https://bit.ly/3FFbFfM (found: 21/11/2021). However, it is likely that this will change over the next decade as a variety of countries and jurisdictions from the US and Japan to the EU begin or prepare to increase support for midstream processing and permanent magnet production.

Graph 3: Estimated market shares of rare earth mining, processing, metals and permanent magnets in 201919Ibid.

The dependence on the DRC is driven by the country’s 70% market share of global production of cobalt in 2019. The majority of this is then processed in the PRC.20‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021). The opportunity here is two fold, first to support the clear desire of the DRC and other developing nations to not be left behind in the green industrial revolution – in this case by investing in the value chain from extraction to processing in both the DRC and potentially neighbouring countries such as Tanzania. Second, to expand production and supply chain development in third countries such as Canada and Australia.

4.0 Conclusion

Much has been written on the subject of critical raw materials and rare earths over the last ten years. Although the UK is late to the creation of an institutional framework for addressing the risks associated with concentration of supplies in PRC and DRC, it now has an opportunity to develop a knowledge base, network of experts, business and investors and a strategy which addresses the twin tracks of resilience and growth.

The establishment of the CMEC, Intelligence Centre and accompanying strategy is a welcome step by HM Government. The opportunity this nascent institutional framework has is to both develop a combined strategy which delivers ‘resilience’ as recommended by the China Research Group and ‘growth’ that enables significant capital formation by British companies.21Julia Pamilih and Chris Cash, ‘The UK and China: Raw Materials’, China Research Group, 11/2021, https://bit.ly/3DI9qrE (found: 21/11/2021). The development of the supply chain required to meet Net Zero targets of the UK and other free and open nations is a significant opportunity for wealth creation. The UK’s strategy will likely differ from the original US strategy with its primary emphasis on defence and also from the EU’s with its emphasis on localisation and control with environmental standards as the main lever. In fact the UK’s approach is likely to have more in common with Japan’s which, though initially anchored in supply security, has also had a strong emphasis on the development of intellectual property and wealth creation via its automotive and industrial firms and the associated investment opportunities.

The UK should not accept at face value the dominance of specific countries in key points of the supply chain. These are industries in flux, and in periods of high growth there is opportunity to take market share for those who are committed and nimble.

By being so, HM Government can not only reduce supply risks but also establish the foundations for manufacturing in the UK to support the levelling-up agenda, the continued alignment of nations such as Japan, Canada, Australia, Indonesia and others behind the opportunities of the Net Zero agenda and the reduction in exposure of the London Stock Exchange to – and by extension British pensioners’ dependence on – coal mining, and the further development of the UK as a centre of mining financing and research. These are significant prizes.

4.1 Policy Recommendations

To address the twin tracks of resilience and growth we recommend the team leading this in the Department for Business Energy and Industrial Strategy consider the following points:

4.1.1 Resilience

As Covid-19 reminded us there are many scenarios in which raw material supply can be disrupted. However, it would be wise to consider responses to general – catch-all scenarios – and specific scenarios, such as:

- A PRC focused restriction – deliberate or accidental – of rare earths or permanent magnet exports;

- A local conflict or resource nationalism driven disruption of cobalt supplies from the DRC;22‘Cobalt, copper: DRC bans export of copper and cobalt concentrates (again)’, Roskill, 28/05/2021, https://bit.ly/3l1bSSF (found: 21/11/2021).

- A multi-state lead competition for control of resources and industrial production.

Responses to the first and second scenarios are likely to be different as HM Government considered the PRC a ‘systematic competitor’ whilst the DRC is one of the least developed countries in the world.

In bringing together the network of expertise to address the resilience related challenges it would be advisable to include and draw on:

- Those with strong understanding of the PRC’s approach to supply chain development;

- Those with strong expertise in the Japanese and US programmes such as those of the Japanese Oil, Gas and Metals National Corporation (JOGMEC) and the US State Department’s Bureau of Energy and Resources;

- Those with a strong experience of metals and mining investment in Africa and the development funding of this such as African Export-Import Bank (Afreximbank);

- Those with strong expertise in production development in Australia, Canada, Vietnam and the US.

The challenges which these individuals identify and the solutions they are likely put forward may include:

- Accelerate the growth of mining and processing in countries such as Australia, Canada, DRC, India, Indonesia, Malaysia, Tanzania, and Vietnam, potentially via co-financing of facilities with other free and open nations including initiatives developing from the Quadrilateral Security Dialogue which committed in September to securing critical infrastructure, including minerals;23‘Quad nations to focus on clean-energy supply chain, says Australia PM’, Reuters, 25/09/2021, https://reut.rs/3CBeBbD (found: 21/11/2021).

- Consider identifying and securing ‘suppliers of last resort’ for rare earths in conjunction with international allies such as Japan;

- Stabilisation needs for DRC – potentially in conjunction with the PRC – should civil or cross border conflict disrupt supplies of cobalt.

4.1.2 Growth

The opportunity for growth, investment and capital formation across the energy transition metals market is considerable and British companies along with those of other free and open nations are well placed to capture market share. The City of London, where many mining companies are already listed, and the wider network of expertise in the UK are a significant asset.

In bringing together the network of expertise to address growth related opportunities it would be advisable to include and draw on:

- Investors: Those from the City of London/financial community with expertise in capital raising and financial management of the metals and mining industry, and industrial/manufactured goods;

- Operators: Those with direct experience of making investments and managing operations in clean transition metals such as Glencore, Anglo-American or BHP Billiton;

- Standards: Those with strong expertise in industry and process specific standards development such as the BSI;

- Governance: Those with strong expertise and network in developing country governance such as the Commonwealth;

- Trade: Those with experience of the trade and behind the border barriers to the free flow of goods such as clean transition metals and associated manufactured goods such as permanent magnets, electric motors and batteries.

The challenges and questions which these individuals identify and the solutions they are likely put forward may include:

- To detail the current industry structure and cost breakdown for the production of critical materials and key end products such as permanent magnets;

- Identify scenarios in which non-Chinese supply of permanent magnets could beat, in terms of quality, cost and environmental standards, existing PRC-located supply. Consult industry on the steps that would be needed to achieve this;

- Consider supporting midstream and downstream investments in the UK recognising the potential drivers of UK-EU Trade and Cooperation Agreement rules of origins for electric vehicles, the rapid growth in domestic demand for electric vehicles supported by the government phase out target; the opportunity to support an integrated supply chain strategy via the Automotive Transformation Fund; and the role of freeports such as Humberside, Liverpool City Region and Teesside;

- Reducing barriers to the import of qualifying raw materials and their processing into refined goods and manufactured products including the option to place certain goods on the UK’s ‘Green 100’ 0% tariff carve-out from the Global Tariff schedule or via bilateral trade negotiations;

- Support the continued development of internationally agreed standards for mining, processing and recycling via the BSI’s involvement in the ISO/TC298 Rare Earth group and others;

- Consider what level of recycling of materials from electronic components including computer waste and electric vehicle batteries is feasible;

- Collaboration with the Japanese and US governments and their respective industrial/ business communities to examine the feasibility of establishing cost and quality competitive processing and manufacturing in the UK;

- Support British SMEs with input from international partners to establish viable UK processing sites and domestic/overseas raw material supply options;

- Support UK listed metals and mining firms to expand production of these raw materials, and to meet environmental, social, and governance standards;

- Give direction and support to the existing scientific and industrial research community working on exploration (via the British Geological Survey), more efficient production processes, demand reduction in industrial usage, replacement products, and improved recovering and recycling (via Innovate UK).

Appendix I: Definitions

I.I Critical materials, critical minerals, energy transition minerals

Critical materials are any material that is 1. economically important; 2. cannot be substituted easily; and 3. are at high risk of supply disruption. The list of what is considered as a ‘critical material’ varies from country to country and over time. For example, the EU’s list has grown from 14 materials in 2011 to 30 in 2020.24‘Communication from the Commission to the European Parliament, the Council, The European Economic and Social Committee and the Committee of Regions’, European Commission, 03/09/2020, https://bit.ly/3DHHbtb (found: 21/11/2021).

Critical minerals are metals and non-metals which are found naturally in the earth that are considered vital for the economy, yet whose supply may be at risk. The term is often used interchangeably with critical materials. The key difference between minerals and materials is that the latter is wider in scope, and might include organic materials or products like steel.

Energy transition minerals are those identified by the IEA as central to

an energy system powered by clean energy technologies… Building solar photovoltaic plants, wind farms and electric vehicles generally requires more minerals than their fossil fuel based counterparts. A typical electric car requires six times the mineral inputs of a conventional car, and an onshore wind plant requires nine times more mineral resources than a gas-fired power plant. Since 2010, the average amount of minerals needed for a new unit of power generation capacity has increased by 50% as the share of renewables has risen.25‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021).

The IEA identifies these minerals as rare earths, silicon, manganese, graphite, cobalt, nickel, lithium and copper (see Appendix II).26Ibid.

Lithium is the lightest known metal and is the key ingredient in lithium-ion batteries, which are used in electric vehicles. Lithium can be found all over the world, with the largest reserves found in Chile, but also in vast quantities in Afghanistan, Argentina, Australia, Bolivia, and the US.27‘Mineral Commodity Summaries 2021’, US Geological Survey, 2021, https://on.doi.gov/3CEW1iH (found: 21/11/2021), p. 99. However, the PRC currently dominates the lithium supply chain, especially for lithium-ion batteries, though Europe and the US are closing the gap.28See: ‘China Dominates the Lithium-ion Battery Supply Chain, but Europe is on the Rise’, BloombergNEF, 16/09/2020, https://bit.ly/3DJN7Sf (found: 21/11/2021) and ‘China continues to dominate lithium battery supply chains but policy support gives US new hope’, Energy Storage News, 08/10/2021, https://bit.ly/3cEcglG (found: 21/11/2021).

Cobalt is a chemical element found in the earth’s crust and, like lithium and nickel, is a key component for the production of electric vehicles.29‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021), p. 7. Unlike lithium and rare earths, global cobalt reserves are much more geographically concentrated, with the majority of the world’s reserves found in the DRC.

I.II Rare earth elements

Rare earth elements (rare earths) are a group of 17 elements that appear in very low concentrations in rock formations and are nearly indistinguishable from each other (see Figure 1). They are usually grouped together as ‘heavy’ and ‘light’ rare earths on critical mineral lists.

Rare earths have become a key ingredient to the global economy due their use in modern technology. Four rare earths in particular (neodymium, praseodymium, dysprosium and terbium) are used to manufacture neodymium–iron–boron (NdFeB) permanent magnets, which are critical for electric vehicles and wind turbines, two key Net Zero technologies.

Rare earths are not in any way rare; they are found all over the world. The supply chain became dominated by the PRC because of systematic support for mining and processing from the 1990s onwards. Deng Xiaoping, then Paramount Leader of the Chinese Communist Party, recognised the growing importance of rare earths, reportedly saying in 1992 that ‘the Middle East has oil; China has rare earths’.30‘China Rattles Its Rare-Earth-Minerals Saber, Again’, Cato Institute, 25/02/2021, https://bit.ly/3cF4MP8 (found: 21/11/2021).

Figure 1: Periodic table showing rare earths

Appendix II: Critical minerals and the global energy transition

The IEA’s Role of Critical Minerals report found that the average amount of minerals needed for a new unit of power generation capacity has increased by 50% since 2010 as the share of renewable energy has risen.31‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021), p. 5. To get to Net Zero, it predicted up to six times more mineral input would be required due to the necessary rollout of Net Zero technologies like renewable energy and electric vehicles.32‘World Energy Outlook 2021’, International Energy Agency, 10/2021, https://bit.ly/3r0ZF4q (found: 21/11/2021), p. 7.

World Energy Outlook 2021 also found that the demand for minerals for batteries will increase in excess of 50 times by 2050. Lithium sees the fastest growth among the key critical minerals, with demand up over 100-times its current level through to 2050, while cobalt, nickel and graphite also see rapid demand growth.33Ibid.

The IEA’s earlier report from May 2021 found that, in a scenario which meets the Paris Agreement goals, clean energy technologies’ share of total demand rises significantly over the next two decades to over 40% for copper and rare earths, 60-70% for nickel and cobalt, and almost 90% for lithium.34‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021), p. 5. It also states that mineral production is ‘more geographically concentrated than oil and gas’.35Ibid., p. 13.

Appendix III: Country profiles

Over the past decade since the 2010 Senkaku fishing dispute and ensuing trade dispute, national governments have started to focus more on supply chains for critical materials and minerals, in some cases publishing strategies or regular communiqués.

The countries can be broadly divided into two groups: ‘buyers’ (the EU (specifically France and Germany), the UK, Japan, South Korea, and the US) and ‘sellers’ (Australia, Canada, PRC, Vietnam). The buyers are aware of Chinese dominance of global supply chains and are looking to diversify extraction supply chains while investing in refining capacity either at home or abroad. The sellers are seeking to protect or enhance their position in the supply chain. Other buyers are trying to mitigate the level of disruption the PRC can cause at short notice via cooperating (Japan, Vietnam) and stockpiling (South Korea).

III.1 People’s Republic of China

The PRC’s dominance of the rare earths supply chain consolidated as demand grew with the rise of technologies such as smartphones. Much of the world suddenly realised the extent of this dominance following the 2010 fishing collision incident.

A dispute following the arrest of the Chinese fisherman led to the PRC reducing its export quotas by 40% in 2010, which sent rare earths prices in the markets outside the PRC soaring.36James Regan, ‘China’s rare earths export cut spurs trade concerns’, Reuters, 29/12/2010, https://reut.rs/3FI440d (found: 21/11/2021). The WTO ruled against the PRC through the Dispute Settlement Body, but by then much of the world had become alarmed at the PRC’s dominance of the rare earths supply chain, represented by a flourish of national strategies and inquiries.

The PRC dominates the global supply chain for many of the world’s critical minerals including in parts of the supply chain beyond mining, such as refining, separation, and processing. The PRC accounts for the majority of world capacity to refine lithium (66%), cobalt (72%) and electric vehicle batteries manufacturing (78%).37‘Green Trade’, UK Board of Trade, 07/2021, https://bit.ly/3DGyu2k (found: 21/11/2021), p. 21. After three decades of growth, the PRC is now leaps and bounds ahead of the rest of the world in terms of capital and experience.

Although the majority of reserves for critical minerals needed in batteries, such as lithium and cobalt, are outside of the PRC, Chinese companies have invested globally to gain controlling stakes in international mining capacity.

In terms of rare earths, the PRC also dominates extraction and production, though it has been an importer of rare earths since 2019, importing 80% of the global supply in that year, despite having the world’s largest reserves at 44 million megatonnes.38Samantha Subin, ‘The new US plan to rival China and end cornering of market in rare earth metals’, CNBC, 07/04/2021, https://cnb.cx/3CNHXUk (found: 21/11/2021). This year, it has increased its production quota by 20% to record highs.39Tom Daly, ‘China hikes 2021 rare earth quotas by 20% to record highs’, Reuters, 30/09/2021, https://reut.rs/3nDxt5u (found: 21/11//2021). The US Department of Defence has stated that ‘the PRC has strategically flooded the global market with rare earth elements at subsidised prices, driven out competitors, and deterred new market entrants’.40‘Assessing and Strengthening the Manufacturing and Defense Industrial Base and Supply Chain Resiliency of the United States’, Department of Defence (United States), 09/2018, https://bit.ly/3CG5XIW (found: 21/11/2021), p. 29.

III.2 United States

The US could be considered a buyer seeking to become a seller of critical minerals. In December 2017, President Donald Trump issued Executive Order 13817 (EO 13817), A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals.41‘A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals’, Department of Commerce (United States), 04/06/2019, https://bit.ly/3DIOAs1 (found: 21/11/2021). It had four strategic goals, including:

- Fostering scientific and technological innovation to ensure resilience of critical supply chains ‘independent of resources and processing from foreign adversaries’;

- Developing domestic critical supply chains;

- Fostering new capabilities to mitigate future challenges;

- Coordinating with international partners and allies to diversify global supply chains and ensure the adoption of best practices for sustainable mining and processing.42‘Critical Minerals and Materials’, Department of Energy (United States), 01/2021, https://bit.ly/3kYjnKd (found: 21/11/2021).

President Joe Biden signed an executive order (EO 14017) in February 2021 to review gaps in the domestic supply chains for key resources (including critical minerals),43‘Executive Order 14017’, The White House, 24/02/2021, https://bit.ly/3HVrYHB (found: 21/11/2021). and in March the US Department of Energy announced a US$30 million initiative that will tap into researching and securing the US domestic supply chain for rare earths and other important minerals in battery making, such as cobalt and lithium. These materials are included in the US$2 trillion funding package currently making its way through the US Congress. The US Office for Energy Efficiency and Renewable Energy released its plans in June 2021 to develop an end-to-end supply chain for lithium batteries, from manufacturing to recycling them, within its borders by the end of the decade.44‘National Blueprint for Lithium Batteries’, Office of Energy Efficiency and Renewable Energy (US), 07/06/2021, https://bit.ly/3DGzMuc (found: 21/11/2021).

As well as developing unilateral solutions to alleviate American dependence on the PRC for critical minerals, the US is also leading on multilateral solutions. The Quadrilateral Security Dialogue – including Australia, India, Japan and the US – is negotiating agreements on cyber security, climate and the Covid-19 pandemic.45Matthew Cranston, ‘Quad to go hard on cyber security, climate and pandemic’, Financial Review, 22/09/2021, https://bit.ly/3xaeHpo (found: 21/11/2021). The four political leaders met in September 2021 for their first in-person ‘Quad’, where they formally agreed to map out supply chains for key products and critical minerals.46Elouise Fowler, ‘Quad critical minerals strategy will take “years to catch up with China”’, Financial Review, 26/09/2021, https://bit.ly/3DGAasE (found: 21/11/2021).

III.3 United Kingdom

The UK has set a carbon neutrality (Net Zero) target for 2050, with an ambitious and enshrined target of a 78% carbon emissions reduction compared to 1990 levels by 2035. It has also set a target for a carbon-free power grid by 2035 (dependent upon security of supply); a 600,000 electric-powered heat pump installation target for 2028, coupled with an ambition to end the installation of new gas boilers for 2035; and a 2030 phase-out date for petrol and diesel vehicles. Meeting all these targets is important for the transition to a Net Zero economy, but they require the scaling up of Net Zero technologies, in particular renewable energy and electric vehicles, which require rare earths and other critical minerals.

In the recently published Net Zero Strategy, HM Government committed to publishing a critical minerals strategy in 2022.47‘Net Zero Strategy: Build Back Greener’, HM Government, 10/2021, https://bit.ly/3l0yFhp (found: 21/11/2021), p. 129. It said Net Zero will mean maximising the value of resources within a more efficient circular economy and a significant increase in the use of certain types of resources – critical minerals, such as lithium, graphite, and cobalt, as well an increased demand on resources, such as copper and steel. For example, the commitment to phase out petrol and diesel cars by 2030 is estimated to generate a need for five times more copper for vehicles and 10 times more primary material per megawatt for offshore wind.48‘APPG Critical Minerals – The EU-UK Trade Deal and Critical Mineral Supply Chains Post-Brexit’, Critical Minerals Association, 01/2021, https://bit.ly/3xdTDhC (found: 21/11/2021). It went on to say that ‘this will require new robust supply chains and provide economic opportunities’.49‘Net Zero Strategy: Build Back Greener’, HM Government, 10/2021, https://bit.ly/3l0yFhp (found: 21/11/2021), p. 87.

Within the Integrated Review, HM Government said it will continue to explore opportunities around domestic extraction and processing of critical minerals, such as lithium, as well as their recovery, recycling and reuse to establish a viable circular economy.50‘Global Britain in a Competitive Age: The Integrated Review of Security, Defence, Development and Foreign Policy’, Cabinet Office, 07/03/2021, https://bit.ly/3vX8RGY (found: 21/11/2021). For further analysis on developing a critical mineral circular economy, see: Susan Evans, Heather Plumpton and Libby Peake, ‘Critical Point: Securing the raw materials needed for the UK’s green transition’, Green Alliance, 2021, https://bit.ly/3cE4DeQ (found: 21/11/2021). The Integrated Review also noted under its section on ‘systemic competition’ that ‘there will be increased competition for scarce natural resources such as critical minerals, including rare earth elements, and control of supply may be used as leverage on other issues’.51‘Global Britain in a Competitive Age: The Integrated Review of Security, Defence, Development and Foreign Policy’, Cabinet Office, 07/03/2021, https://bit.ly/3vX8RGY (found: 21/11/2021). HM Government announced plans to set up a CMEC, Intelligence Centre and Strategy to provide independent advice on the scope and content of a critical minerals strategy to meet the country’s Net Zero carbon emissions targets.52Andrea Hotter, ‘UK to set up critical minerals committee’, Metal Bulletin, 21/10/2021, https://bit.ly/3oU4B8k (found: 21/11/2021).

In response to an adjournment debate led by Alexander Stafford MP on Monday, 15th March 2021, Anne-Marie Trevelyan MP, the Minister for Business, Energy and Clean Growth, said:

We are absolutely committed to exploring and developing lithium mining in the UK. We have backed Cornish Lithium and Geothermal Engineering, which are collaborating to build a zero-carbon lithium extraction pipe plant at an existing site in Cornwall.53Anne Marie Trevellyan, ‘UK Renewables: Critical Minerals’, UK Parliament, 15/03/2021, https://bit.ly/3l3fund (found: 21/11/2021).

The minister also confirmed that HM Government’s foreign direct investment strategy is focused on securing investment in the extraction and, crucially, processing of these commodities and working to improve international mining conditions to tackle modern slavery.54Ibid.

The UK is also investing £1 billion through the Automotive Transformation Fund to build an internationally competitive end-to-end electric vehicle supply chain, including batteries and recycling. £500 million of funding through the fund will be made available in the next four years to invest in capital and research and development projects to build an internationally competitive electric vehicle supply chain.55‘Decarbonising Transport: A Better, Greener Britain’, Department for Transport, 07/2021, https://bit.ly/3FElwm9 (found: 21/11/2021), p. 88 and p. 100. HM Government is also investing £330 million through the Faraday Battery Challenge to the reuse and recycling of battery components.56Catherine West, ‘Written Question on Electric Vehicles: Recycling’, UK Parliament, 23/07/2021, https://bit.ly/3CJ3mh4 (found: 21/11/2021).

In 2020, the Department for International Trade’s new UK Global Tariff unilaterally cut tariffs on 104 ‘green goods’. These included two-thirds of the goods covered by the most recent round of the Environmental Goods Act as well as all those deemed environmentally beneficial under the EU’s tariff policy.57‘Green Trade’, UK Board of Trade, 07/2021, https://bit.ly/3DGyu2k (found: 21/11/2021). More products, including those covered by this paper, could be added to the green goods list to cut the import tariff to 0% for third countries.

In terms of standards, the Department for International Trade and the Cabinet Office supported a recent Wilton Park conference which sought to identify and catalyse practical steps to develop coordination and governance for critical minerals worldwide. It will develop greater regulatory and practical cooperation on technology-critical minerals, as part of the UK’s presidency of COP26.58Alexander Stafford, ‘Written Question on Mining: Standards’, UK Parliament, 14/06/2021, https://bit.ly/3kV6oJa (found: 21/11/2021).

III.4 Australia

The Australian Government published its critical minerals strategy in 2019 which stated an intention to enable the development of Australia’s critical minerals sector including downstream processing and manufacturing opportunities.59‘Australia’s Critical Minerals Strategy’, Department of Industry, Science, Energy and Resources (Australia), 03/2019, https://bit.ly/3oNwbEp (found: 21/11/2021). Australia is already a world leader in the exploration, extraction, production and processing of critical minerals. The strategy targets action in three key areas:

- Promoting investment in Australia’s critical minerals sector and downstream processing;

- Providing incentives for innovation to lower costs and increase competitiveness;

- Connecting critical minerals projects with infrastructure development.60Ibid.

Australia has the world’s third largest reserves of lithium and is the largest producer in the world (about 40% of the world’s supply of lithium comes from Australia).61‘Green Trade’, UK Board of Trade, 07/2021, https://bit.ly/3DGyu2k (found: 21/11/2021), p. 21. It is ranked sixth in the world for rare earths reserves but is second for production; many of these deposits remain untapped. It also has large resources of cobalt, manganese, tantalum, tungsten, and zirconium.62Ibid.

III.5 Canada

Similar to Australia, the Canadian Government is seeking to position Canada as a global supplier of choice in critical minerals. It states ‘economies that quickly secure a position in shifting [critical mineral] supply chains will be well situated for long-term economic growth and prosperity’, due to the role that critical minerals play in the transition to a low-carbon and digitised economy.63Critical Minerals’, Government of Canada, 03/2019, https://bit.ly/3oPtQsn (found: 21/11/2021).

Canada published the Canadian Minerals and Metals Plan in 2019. Canada produces some 60 minerals and metals at 200 active mines and 7,000 pits and quarries, and is ranked fourth in the world for cobalt (reserves worth US$277 million) and twelfth for copper (reserves worth US$4.7 billion).64‘The Canadian Minerals and Metals Plan’, Government of Canada, 03/2019, https://bit.ly/2ZfUG4m (found: 21/11/2021), p. 1.

III.6 Japan, South Korea, and Vietnam

Vietnam is second only to the PRC in rare earths reserves at 22 million megatonnes. Major concentrations are found against its northwestern border with the PRC and along its eastern coastline. In an effort to overcome the PRC’s near-monopoly on the supply of rare earths, Vietnam and Japan have started to work together by launching a research centre in Hanoi to improve extraction and processing of the materials. Japan counts recycling restrictions as part of its definition of critical alongside supply risk, price risk, demand risk, and potential risk.65See: Hiroki Hatayama and Kiyotaka Tahara, ‘Criticality Assessment of Metals for Japan’s Resource Strategy’, Materials Transitions, 56:2 (2015).

South Korea announced plans in August 2021 to raise its stockpiles of critical metals such as cobalt, nickel and rare earths that are used in key emerging industries including electric vehicle batteries and renewable energy. The South Korean Government set a target to increase its stockpiles to cover 100 days of consumption, up from 56.8 days currently.66‘42nd Meeting of Central Economic Response Headquarters’, Ministry of Culture, Sports and Tourism (South Korea), 05/08/2021, https://bit.ly/3r26d2C (found: 21/11/2021).

III.7 European Union

The EU frames access to resources as a ‘strategic security question for Europe’s ambition to deliver the Green Deal’ and as part of its desire to become strategically autonomous.67Thierry Breton, Speech: ‘Speech at EIT Raw Materials Summit’, EIT Raw Materials Summit, 17/06/2021, https://bit.ly/3CHR7kQ (found: 21/11/2021). It also notes the warning that the transition to a climate neutral (Net Zero) economy ‘could replace today’s reliance on fossil fuels with one on raw materials, many of which we source from abroad and for which global competition is becoming more fierce.’68‘Communication from the Commission to the European Parliament, the Council, The European Economic and Social Committee and the Committee of Regions’, European Commission, 03/09/2020, https://bit.ly/3DHHbtb (found: 21/11/2021).

The EU released its Action Plan in 2020 to make Europe’s raw materials supply more secure and sustainable.69‘Press Release: “Commission announces actions to make Europe’s raw materials supply more secure and sustainable”’, European Commission, 03/09/2020, https://bit.ly/3nEAzWF (found: 21/11/2021). The plan proposes actions to reduce Europe’s dependency on third countries, diversifying supply from both primary and secondary sources and improving resource efficiency and circularity while promoting responsible sourcing worldwide. It also launched a ‘European Raw Materials Alliance’ (ERMA).

In addition, the two largest economies in the EU have developed their own approaches:

- France’s Parliamentary Office for the Evaluation of Scientific and Technological Choices published a study in 2016 on critical minerals and rare earths.70Patrick Hetzel and Delphine Bataille, ‘Les Enjeux Stratégiques des Terres Rareset des Matières Premières Stratégiques et Critiques’ [‘The Strategic Issues of Rare Earths and Strategic and Critical Raw Materials’], Office parlementaire d’évaluation des choix scientifiques et technologiques [Parliamentary Office for the Evaluation of Scientific and Technological Choices], 05/2016, https://bit.ly/3r14wTc (found: 21/11/2021). It recommended 14 policies for developing policy, including publishing a comprehensive strategy, considering stockpiling, developing the French mining industry, and working at the European level to secure critical minerals to increase European strategic autonomy. France has not developed its own national strategy, likely due to the EU’s work on this. It currently imports almost 100% of its metals and a significant proportion of the strategic minerals that its industry uses.71‘Matières mobilisées par l’économie française: une baisse stabilisée depuis la crise de 2008’[‘Materials mobilised by the French economy: a stabilised decline since the 2008 crisis’], Service de l’observation et des statistiques [Observation and Statistics Service] (France), 05/2016, https://bit.ly/3oU70Qo (found: 21/11/2021). If it were to develop its lithium reserves, France could be self-sufficient with a potential production of more than 200,000 tonnes of lithium metal.72Eric Glouguen et al., ‘Ressources métropolitaines en lithium et analyse de potentiel par méthodes de prédictivité’ [‘Metropolitan lithium resources and potential analysis using predictive methods’], Ministère de la Transition Écologique et Solidaire [Ministry of Ecological and Inclusive Transition] (France), 12/2018, https://bit.ly/3cCNAtH (found: 21/11/2021).

- Germany has a Raw Materials Strategy from 2010 which the Federal Government is currently revising.73‘The German Government’s raw material strategy’, Federal Ministry of Economics and Technology (Germany), 10/2010, https://bit.ly/30QZttv (found: 21/11/2021). It is trying to predict which minerals to extract from within its borders to meet demand cost-efficiently.74‘Raw Materials – indispensable for Germany’s industrial future’, Federal Ministry of Economics and Technology (Germany), 2021, https://bit.ly/3kYOQMr (found: 21/11/2021). Germany is an export-oriented manufacturing economy which is highly dependent on a stable supply of raw materials, smooth trade flows and a functioning global free trade regime. Germany has also the highest trade deficit in raw material trade among all EU member states.75Schmid, Marc, ‘The Revised German Raw Materials Strategy in the Light of Global Political and Market Developments’, Review of Policy Research, 38:1 (2021). Germany’s Ministry for Economic Affairs and Energy is providing funding for a number of Competence Centres for Mining and Mineral Resources that have been established within the bilateral chambers of commerce and industry in selected mining countries. Germany also says it is aiming to promote transparency and due diligence in the supply chain. It also set up bilateral partnerships with Kazakhstan, Mongolia, and Peru.76Ibid.

About the authors

William Young is a Director at BloombergNEF, Bloomberg’s strategic research business and climate lead on the East-West focused New Economy Forum. He was formerly Chief of Staff to the Chief Executive Officer and Chief Operations Officer and prior to that was instrumental in launching BloombergNEF’s research capabilities and advising clients on technology, finance, economics, politics and business opportunities in the transition to a low carbon economy. He is also a William Stanley Jevons Associate Fellow in Environmental Security at the Council on Geostrategy. He holds an MSc in International Strategy and Diplomacy from the London School of Economics and an MA (Hons) in Modern History from the University of Oxford.

Jack Richardson is the Climate Programmes Coordinator at the Conservative Environment Network, an independent forum that brings together Conservatives who support decarbonisation and conservation. He is also James Blyth Early Career Associate Fellow in Environmental Security at the Council on Geostrategy. He studied Politics at the University of Exeter and is embarking upon a Masters degree in International Political Economy at King’s College, London.

Acknowledgments

The authors would like to thank Sam Hall, Director of the Conservative Environmental Network (CEN), and Kwasi Ampofo, Head of Metals and Mining at BloombergNEF, for feedback on previous drafts. The authors would also like to thank the following for valuable conversations related but not directly linked to this paper: Alexander Stafford, Member of Parliament for Rother Valley. All responsibility for the contents of this paper including omissions and inaccuracies lie with the authors.

The Council on Geostrategy is grateful to the Conservative Environment Network (CEN), whose funding has made this study possible.

Disclaimer

This publication should not be considered in any way to constitute advice. It is for knowledge and educational purposes only. The views expressed in this publication are those of the author and do not necessarily reflect the views of the Council on Geostrategy or the views of its Advisory Council.

No. ESPPP01 | ISBN: 978-1-914441-16-5

- 1Fatih Birol, Executive Director of the International Energy Agency (IEA), quoted in: ‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021).

- 2To assist the reader, certain terms and concepts are highlighted in bold on first mention. These terms and concepts are explained in Appendix I.

- 3Julieanna Powell-Turner and Peter D. Antill, ‘Critical Raw Materials and UK Defence Acquisition: The Case of the Rare Earth Elements’, Kevin Burgess and Peter Antill (eds.), Emerging Strategies in Defence Acquisitions and Military Procurement (Hershey, Pennsylvania: IGI Global, 2016).

- 4Richard Silberglitt et al., ‘Critical Materials: Present Danger to US Manufacturing’, RAND Corporation, 2013, https://bit.ly/3DIJkF0 (found: 21/11/2021).

- 5‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021), p. 153.

- 6Birol, quoted in: ‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021).

- 7Ibid.

- 8‘Global Britain in a Competitive Age: The Integrated Review of Security, Defence, Development and Foreign Policy’, Cabinet Office, 07/03/2021, https://bit.ly/3vX8RGY (found: 21/11/2021).

- 9‘Global Britain in a Competitive Age: The Integrated Review of Security, Defence, Development and Foreign Policy’, Cabinet Office, 07/03/2021, https://bit.ly/3vX8RGY (found: 21/11/2021).

- 10‘Net Zero Strategy: Build Back Greener’, HM Government, 10/2021, https://bit.ly/3l0yFhp (found: 21/11/2021), p. 237.

- 11Julian Ryall, ‘Japan moves to secure rare earths to reduce dependence on China’, South China Morning Post, 17/08/2020, https://bit.ly/30JTdEh (found: 21/11/2021).

- 12Kim Byung-wook, ‘S. Korea to beef up critical metals stockpile’, The Korea Herald, 05/08/2021, https://bit.ly/3CT75ZT (found: 21/11/2021).

- 13‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021).

- 14‘Rare Earths Statistics and Information’, US Geological Survey, No date, https://on.doi.gov/3DEjyBH (found: 21/11/2021).

- 15‘BNEF Takes on COP26: Day 1-3 Highlights’, BloombergNEF, 02/11/2021, https://bit.ly/3r2syx6 (found: 13/11/2021).

- 16‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021).

- 17‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021).

- 18‘Rare Earth Magnets and Motors’, EIT Raw Materials, 2021, https://bit.ly/3FFbFfM (found: 21/11/2021).

- 19Ibid.

- 20‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021).

- 21Julia Pamilih and Chris Cash, ‘The UK and China: Raw Materials’, China Research Group, 11/2021, https://bit.ly/3DI9qrE (found: 21/11/2021).

- 22‘Cobalt, copper: DRC bans export of copper and cobalt concentrates (again)’, Roskill, 28/05/2021, https://bit.ly/3l1bSSF (found: 21/11/2021).

- 23‘Quad nations to focus on clean-energy supply chain, says Australia PM’, Reuters, 25/09/2021, https://reut.rs/3CBeBbD (found: 21/11/2021).

- 24‘Communication from the Commission to the European Parliament, the Council, The European Economic and Social Committee and the Committee of Regions’, European Commission, 03/09/2020, https://bit.ly/3DHHbtb (found: 21/11/2021).

- 25‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021).

- 26Ibid.

- 27‘Mineral Commodity Summaries 2021’, US Geological Survey, 2021, https://on.doi.gov/3CEW1iH (found: 21/11/2021), p. 99.

- 28See: ‘China Dominates the Lithium-ion Battery Supply Chain, but Europe is on the Rise’, BloombergNEF, 16/09/2020, https://bit.ly/3DJN7Sf (found: 21/11/2021) and ‘China continues to dominate lithium battery supply chains but policy support gives US new hope’, Energy Storage News, 08/10/2021, https://bit.ly/3cEcglG (found: 21/11/2021).

- 29‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021), p. 7.

- 30‘China Rattles Its Rare-Earth-Minerals Saber, Again’, Cato Institute, 25/02/2021, https://bit.ly/3cF4MP8 (found: 21/11/2021).

- 31‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021), p. 5.

- 32‘World Energy Outlook 2021’, International Energy Agency, 10/2021, https://bit.ly/3r0ZF4q (found: 21/11/2021), p. 7.

- 33Ibid.

- 34‘The Role of Critical Minerals in Clean Energy Transitions’, International Energy Agency, 05/2021, https://bit.ly/30QtR71 (found: 21/11/2021), p. 5.

- 35Ibid., p. 13.

- 36James Regan, ‘China’s rare earths export cut spurs trade concerns’, Reuters, 29/12/2010, https://reut.rs/3FI440d (found: 21/11/2021).

- 37‘Green Trade’, UK Board of Trade, 07/2021, https://bit.ly/3DGyu2k (found: 21/11/2021), p. 21.

- 38Samantha Subin, ‘The new US plan to rival China and end cornering of market in rare earth metals’, CNBC, 07/04/2021, https://cnb.cx/3CNHXUk (found: 21/11/2021).

- 39Tom Daly, ‘China hikes 2021 rare earth quotas by 20% to record highs’, Reuters, 30/09/2021, https://reut.rs/3nDxt5u (found: 21/11//2021).

- 40‘Assessing and Strengthening the Manufacturing and Defense Industrial Base and Supply Chain Resiliency of the United States’, Department of Defence (United States), 09/2018, https://bit.ly/3CG5XIW (found: 21/11/2021), p. 29.

- 41‘A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals’, Department of Commerce (United States), 04/06/2019, https://bit.ly/3DIOAs1 (found: 21/11/2021).

- 42‘Critical Minerals and Materials’, Department of Energy (United States), 01/2021, https://bit.ly/3kYjnKd (found: 21/11/2021).

- 43‘Executive Order 14017’, The White House, 24/02/2021, https://bit.ly/3HVrYHB (found: 21/11/2021).

- 44‘National Blueprint for Lithium Batteries’, Office of Energy Efficiency and Renewable Energy (US), 07/06/2021, https://bit.ly/3DGzMuc (found: 21/11/2021).

- 45Matthew Cranston, ‘Quad to go hard on cyber security, climate and pandemic’, Financial Review, 22/09/2021, https://bit.ly/3xaeHpo (found: 21/11/2021).

- 46Elouise Fowler, ‘Quad critical minerals strategy will take “years to catch up with China”’, Financial Review, 26/09/2021, https://bit.ly/3DGAasE (found: 21/11/2021).

- 47‘Net Zero Strategy: Build Back Greener’, HM Government, 10/2021, https://bit.ly/3l0yFhp (found: 21/11/2021), p. 129.

- 48‘APPG Critical Minerals – The EU-UK Trade Deal and Critical Mineral Supply Chains Post-Brexit’, Critical Minerals Association, 01/2021, https://bit.ly/3xdTDhC (found: 21/11/2021).

- 49‘Net Zero Strategy: Build Back Greener’, HM Government, 10/2021, https://bit.ly/3l0yFhp (found: 21/11/2021), p. 87.

- 50‘Global Britain in a Competitive Age: The Integrated Review of Security, Defence, Development and Foreign Policy’, Cabinet Office, 07/03/2021, https://bit.ly/3vX8RGY (found: 21/11/2021). For further analysis on developing a critical mineral circular economy, see: Susan Evans, Heather Plumpton and Libby Peake, ‘Critical Point: Securing the raw materials needed for the UK’s green transition’, Green Alliance, 2021, https://bit.ly/3cE4DeQ (found: 21/11/2021).

- 51‘Global Britain in a Competitive Age: The Integrated Review of Security, Defence, Development and Foreign Policy’, Cabinet Office, 07/03/2021, https://bit.ly/3vX8RGY (found: 21/11/2021).

- 52Andrea Hotter, ‘UK to set up critical minerals committee’, Metal Bulletin, 21/10/2021, https://bit.ly/3oU4B8k (found: 21/11/2021).

- 53Anne Marie Trevellyan, ‘UK Renewables: Critical Minerals’, UK Parliament, 15/03/2021, https://bit.ly/3l3fund (found: 21/11/2021).

- 54Ibid.

- 55‘Decarbonising Transport: A Better, Greener Britain’, Department for Transport, 07/2021, https://bit.ly/3FElwm9 (found: 21/11/2021), p. 88 and p. 100.

- 56Catherine West, ‘Written Question on Electric Vehicles: Recycling’, UK Parliament, 23/07/2021, https://bit.ly/3CJ3mh4 (found: 21/11/2021).

- 57‘Green Trade’, UK Board of Trade, 07/2021, https://bit.ly/3DGyu2k (found: 21/11/2021).

- 58Alexander Stafford, ‘Written Question on Mining: Standards’, UK Parliament, 14/06/2021, https://bit.ly/3kV6oJa (found: 21/11/2021).

- 59‘Australia’s Critical Minerals Strategy’, Department of Industry, Science, Energy and Resources (Australia), 03/2019, https://bit.ly/3oNwbEp (found: 21/11/2021).

- 60Ibid.

- 61‘Green Trade’, UK Board of Trade, 07/2021, https://bit.ly/3DGyu2k (found: 21/11/2021), p. 21.

- 62Ibid.

- 63Critical Minerals’, Government of Canada, 03/2019, https://bit.ly/3oPtQsn (found: 21/11/2021).

- 64‘The Canadian Minerals and Metals Plan’, Government of Canada, 03/2019, https://bit.ly/2ZfUG4m (found: 21/11/2021), p. 1.

- 65See: Hiroki Hatayama and Kiyotaka Tahara, ‘Criticality Assessment of Metals for Japan’s Resource Strategy’, Materials Transitions, 56:2 (2015).

- 66‘42nd Meeting of Central Economic Response Headquarters’, Ministry of Culture, Sports and Tourism (South Korea), 05/08/2021, https://bit.ly/3r26d2C (found: 21/11/2021).

- 67Thierry Breton, Speech: ‘Speech at EIT Raw Materials Summit’, EIT Raw Materials Summit, 17/06/2021, https://bit.ly/3CHR7kQ (found: 21/11/2021).

- 68‘Communication from the Commission to the European Parliament, the Council, The European Economic and Social Committee and the Committee of Regions’, European Commission, 03/09/2020, https://bit.ly/3DHHbtb (found: 21/11/2021).

- 69‘Press Release: “Commission announces actions to make Europe’s raw materials supply more secure and sustainable”’, European Commission, 03/09/2020, https://bit.ly/3nEAzWF (found: 21/11/2021).

- 70Patrick Hetzel and Delphine Bataille, ‘Les Enjeux Stratégiques des Terres Rareset des Matières Premières Stratégiques et Critiques’ [‘The Strategic Issues of Rare Earths and Strategic and Critical Raw Materials’], Office parlementaire d’évaluation des choix scientifiques et technologiques [Parliamentary Office for the Evaluation of Scientific and Technological Choices], 05/2016, https://bit.ly/3r14wTc (found: 21/11/2021).

- 71‘Matières mobilisées par l’économie française: une baisse stabilisée depuis la crise de 2008’[‘Materials mobilised by the French economy: a stabilised decline since the 2008 crisis’], Service de l’observation et des statistiques [Observation and Statistics Service] (France), 05/2016, https://bit.ly/3oU70Qo (found: 21/11/2021).

- 72Eric Glouguen et al., ‘Ressources métropolitaines en lithium et analyse de potentiel par méthodes de prédictivité’ [‘Metropolitan lithium resources and potential analysis using predictive methods’], Ministère de la Transition Écologique et Solidaire [Ministry of Ecological and Inclusive Transition] (France), 12/2018, https://bit.ly/3cCNAtH (found: 21/11/2021).

- 73‘The German Government’s raw material strategy’, Federal Ministry of Economics and Technology (Germany), 10/2010, https://bit.ly/30QZttv (found: 21/11/2021).

- 74‘Raw Materials – indispensable for Germany’s industrial future’, Federal Ministry of Economics and Technology (Germany), 2021, https://bit.ly/3kYOQMr (found: 21/11/2021).

- 75Schmid, Marc, ‘The Revised German Raw Materials Strategy in the Light of Global Political and Market Developments’, Review of Policy Research, 38:1 (2021).

- 76Ibid.