Foreword

The European Union’s (EU) dependence on Russia for energy is enormous. Ever since the construction of the Trans-Siberian Pipeline into Western Europe between 1982 and 1984, free and open nations have feared the leverage Russian energy exports may grant the Kremlin.

Yet, Russia’s vast mineral resources and close proximity to Europe left it a natural economic partner, assuaging such fears.

Today it is clear that not only did these imports give Russia undue leverage, but they directly funded the Kremlin’s expansionist agenda.

EU countries, it seemed, initially accepted these facts. Russia’s aggressive use of differential energy pricing to punish or reward political acts, undermining its reliability as a trading partner, did not prompt a shift in policy. Nor did Russia’s invasion of Georgia in 2008 and illegal annexation of Crimea in 2014 – the EU’s import dependency on Russia for energy actually increased in this period.

Russia’s renewed invasion of Ukraine earlier this year seems to have finally woken the EU up to the dangers of relying on Russia for energy. The horrors that these imports finance have become all too clear. A long and much needed process for the EU has now begun: weaning themselves off Russian energy imports.

This Report, by Alexander Lanoszka, James Rogers and Patrick Triglavcanin, is of great importance in the current geopolitical context as it outlines Ukraine’s potential to act as a stable and secure supplier of energy to the EU. It also helps us to understand why the EU is in need of an innovative and new energy strategy.

The paper clearly identifies the quagmire the EU finds itself in regarding energy imports from Russia – and the massive amounts of capital this trade produces – before breaking down Ukraine’s pivotal role in providing an alternative to Russian imports.

As the Kremlin’s true intentions on revising the existing global order become clearer, so does the need to combat it at every cost. Cutting off Russia’s energy export lifeline will be crucial in this battle. And no nation is more fit to fill this gap than Ukraine.

– The Lord Risby

Chair of the Advisory Council, Council on Geostrategy

Executive summary

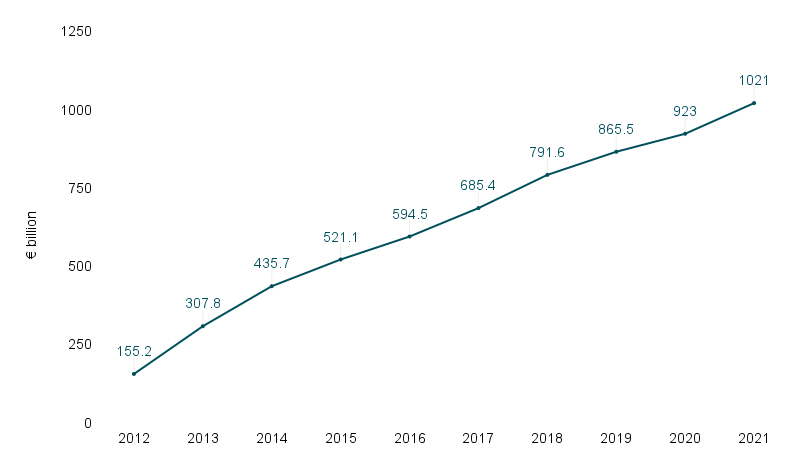

- The EU has increasingly become more reliant on Russia for energy imports. This was initially a fact that most European governments accepted, despite signs of Russia’s intentions to use such imports as a weapon, and to disrupt the international order more broadly. Indeed, over the past 10 years, the EU has transferred approximately €1 trillion to Russia in exchange for fossil fuels.

- Russia’s invasion of Ukraine has made halting Russian energy imports a priority for the EU. Though major steps have been taken, further action is required to ensure greater European sovereignty over energy supplies and promote the decarbonisation of the continent.

- In order to achieve this, the EU will need to take decisive measures against Russian supplies of fossil fuels. It will also need to expand its relationship with new and existing partners. Embracing Ukraine will be key in this endeavour due to the country’s considerable potential as an energy provider.

- Ukraine has the second largest gas reserves in Europe and holds equivalent to 27% of the EU’s gas storage capacity. It also has abundant wind and solar resources that can be better harnessed and exported to the EU, amongst other capabilities.

- But to become a stable and reliable EU partner, Ukraine needs support in meeting its long-term energy policy. To maximise its potential and to facilitate a closer energy partnership with the EU, Ukraine would do well to undertake a ream of reforms to its energy sector. These reforms should address:

- Affordability

- Fully integrate the Ukrainian energy sector with the EU;

- Decrease regulatory interference in Ukraine’s electricity market.

- Security of supply

- Implement a stimulus package for oil and gas extraction;

- Introduce capacity mechanisms in support of medium and long term electricity supply security;

- Improve financial instruments to ensure a green energy transition;

- Reform the coal sector;

- Implement smart grids and improve cross-border connectivity.

- Sustainability

- Boost policy support for the development of new technologies.

- Affordability

1.0 Introduction

On 15th November 2021, Boris Johnson, the British Prime Minister, made a prescient remark in his annual speech on foreign policy to the Mansion House in London:

And we hope, I hope, that others may recognise, other European countries may recognise, that a choice is shortly coming, between mainlining ever more Russian hydrocarbons in giant new pipelines, and sticking up for Ukraine and championing the cause of peace and stability.1Boris Johnson, Speech: ‘PM speech to the Lord Mayor’s Banquet’, Prime Minister’s Office, 10 Downing Street, 15/11/2021, https://bit.ly/3ySgB0U (checked: 31/05/2021).

Even without the construction of the Nord Stream II pipeline between Germany and Russia – the ‘giant new pipeline’ to which Johnson was referring – the extent of the EU’s Russian energy imports is breathtaking. In 2021, the EU purchased €5.5 billion in coal from Russia, €21.7 billion in gas, and a whopping €70.8 billion of oil.2These statistics have been calculated using the Eurostat Comext database. The products have been selected using Standard International Trade Classification Revision 4 and were chosen to best represent those used for energy. They are as follows: SITC 32 (Coal, coke and briquettes), SITC 333 (Petroleum oils from natural gas condensates), SITC 334 (Petroleum oils and oils obtained from bituminous minerals, crude) and SITC 343 (Natural gas, whether or not liquified). ‘Import value’ refers to the overall trade value of a product. See: ‘EU Trade since 1999 by SITC’, Eurostat Comext, 16/05/2022, https://bit.ly/3x5lYZn (checked: 31/05/2022). Further statistics using this database follow the same method of calculation. Energy represented 60.3% of the EU’s total import value from Russia that year, and totalled around €98 billion.3Ibid. In other words, if averaged over the course of the year, the EU transfers around €268.5 million to Russia each day in exchange for energy. This means that the EU has paid just over €1.02 trillion to Russia over the past ten years for supplies of oil, gas and coal – an astonishing amount (see Chart 1).4Ibid.

Chart 1: Russia’s revenue from fossil fuel sales to the EU

With Russia’s renewed offensive against Ukraine, it is no longer possible to argue – as Angela Merkel, former Chancellor of Germany, once did in relation to Nord Stream II – that Russia does ‘not want to use energy as a weapon.’6See: ‘Mixed responses to US-Germany Nord Stream 2 deal’, DW, 22/07/2021, https://bit.ly/3wYbY2K (checked: 31/05/2022). In buying Russian fossil fuels, the EU has strengthened Vladimir Putin’s whip hand in the Kremlin and Russia more generally; more importantly, the revenues generated have provided much of the funds for his regime’s military modernisation programmes, intelligence operations, discursive statecraft, and wars of conquest.7Discursive statecraft includes all forms of legitimate narrative projection, as well as illegitimate disinformation and propaganda campaigns. Governments engage in discursive statecraft to change perceptions of countries and ideas at the international level to the extent that the parameters of debate are controlled in accordance with their interests. For more on discursive statecraft, see: ‘Discursive Statecraft’, Council on Geostrategy, No date, https://bit.ly/3m66hul (checked: 31/05/2022). For perspective, annual EU payments for Russian energy in 2021 amounted to:

- Nearly 1/16th of Russia’s estimated Gross Domestic Product (GDP);

- Just over 1/3rd of the Russian Government’s federal budget, which includes a US$16.8 billion (€15.7 billion) budget surplus; or,

- One and 2/3rds greater than Russia’s annual defence expenditure, which ranks fifth globally (after the United States (US), the People’s Republic of China, the United Kingdom (UK) and India).8According to the International Monetary Fund, Russia’s GDP estimate for 2021 was US$1.76 trillion (€1.64 trillion). See: ‘World Economic Outlook’, International Monetary Fund, 19/04/2022, https://bit.ly/3sPCHNy (checked: 31/05/2022). The Russian news agency TASS Russian News Agency reports that Russia’s federal budget for 2022 will be US$315 billion (€294 billion). See: ‘Russia will have budget surplus in 2022 – PM’, TASS Russian News Agency, 07/04/2022, https://bit.ly/38zV4iN (checked: 31/05/2022). The International Institute for Strategic Studies calculates Russia’s defence spending to have been US$62.2 billion (€58.1 billion) in 2021. See: ‘Military Balance 2022 Further assessments’, International Institute for Strategic Studies, 15/02/2022, https://bit.ly/39M3sM4 (checked: 31/05/2022). US Dollars were converted to Euros using Google on 08/06/2022 when US$1 was worth €0.93.

Without the EU’s revenue stream for energy, the Kremlin would find it harder to dominate and shape Russia’s domestic political space or mount expansive geopolitical thrusts against other countries in the EU’s own backyard, to say nothing about the Kremlin’s ability to wage war against Ukraine.

Despite Russia’s annexation of Crimea in 2014 (or, for that matter, aggression towards Georgia in 2008), the EU pushed ahead with its energy relationship with Russia, subsequently becoming even more reliant on Russian imports, particularly of natural gas.9‘EU energy mix and import dependency’, Eurostat, 04/03/2022, https://bit.ly/3LAo8Eb (checked: 31/05/2022). The largest European governments, not least Germany’s, appeared only too willing to accept the political, economic and geostrategic implications of this approach, both for its neighbours and for the EU, more generally. How far the EU and Germany are prepared to go in reducing their dependence on Russian fossil fuels is still unclear. Promisingly, the scale and ferocity of the Kremlin’s renewed offensive against Ukraine in 2022, combined with growing and increasingly public pressure from foreign governments (especially from the Baltic states, Poland, the UK and the US),10During Autumn 2021 and Winter 2022, British and American leaders became increasingly outspoken of European dependency on Russian energy. Johnson condemned Nord Stream II in his annual speech to the Lord Mayor’s Banquet in November 2021. Liz Truss also condemned the pipeline in a commentary for the Daily Telegraph in November 2021 and during a speech at Chatham House in 2022. See: Boris Johnson, Speech: ‘PM speech to the Lord Mayor’s Banquet’, Prime Minister’s Office, 10 Downing Street, 15/11/2021, https://bit.ly/3ySgB0U (checked: 31/05/2021); Liz Truss, ‘We must stand together for freedom and democracy’, Daily Telegraph, 13/11/2021, https://bit.ly/3sPgMX4 (checked: 31/05/2022) and Liz Truss, Speech: ‘Building the Network of Liberty’, 08/12/2021, Foreign, Commonwealth and Development Office, https://bit.ly/3sTQZNd (checked: 31/05/2022). Johnson also condemned European energy dependency when he was Foreign Secretary in 2018. See: Patrick Wintour, ‘Boris Johnson joins US in criticising Russia to Germany gas pipeline’, The Guardian, 22/05/2018, https://bit.ly/3PyAIqJ (checked: 31/05/2022). appears to have encouraged certain EU countries – with Germany among them – to change course.

In response to Russia’s renewed offensive, the European Commission issued the ‘REPowerEU’ communication to the European Council, European Parliament and EU national governments on 18th May. REPowerEU explains how European countries – and the EU as a whole – can reduce their energy dependency on Russia. In its own words, it ‘sets out actions to ramp up the production of green energy, diversify supplies and reduce demand, focusing primarily on gas’, while ‘phasing out dependence on Russian oil and coal, for which the EU has a broader diversity of potential suppliers.’11‘REPowerEU: Joint European Action for more affordable, secure and sustainable energy’, European Commission, 08/03/2022, https://bit.ly/3LH0Z2W (checked: 31/05/2022). Yet, the extent to which European governments, and the EU as a whole, can reduce their dependence on Russia’s energy supplies remains to be seen. Although they have already agreed to terminate Russian coal and significantly reduce Russian oil imports by the end of the year, the phasing out of natural gas will be far more difficult.

Consequently, this Report examines the EU’s reliance on Russia as an energy supplier and looks into how the EU – an important UK partner and component of European security – can take measures to reduce its dependency on Russia. In so doing, it focuses on how Ukraine – which has acted as a reliable energy transmission partner for the EU since the collapse of the Soviet Union – can help the EU diversify its energy imports. Moreover, it identifies those measures that Ukraine should take to consolidate its position as an energy partner of the EU so as to enhance its attractiveness as a future member of the bloc and speed up the greening of the Ukrainian economy. With these goals in mind, this Report has four remaining sections: Section 2.0 focuses on the extent of Europe’s reliance on Russian energy resources; Section 3.0 looks at the EU’s efforts to transform its own energy sector; Section 4.0 identifies Ukraine’s potential as a reliable partner in reducing EU dependency on Russia; and Section 5.0 concludes and proposes the reforms the EU and Ukraine ought to make to ‘green’, enhance and entwine their energy sectors for mutual benefit.

2.0 Europe’s dependence on Russia’s fossil fuels

The extent of EU dependence on Russian fossil fuels is different depending on whether it is gas, oil or coal. While the EU is largely dependent on Russia for gas, it is less dependent on Russian oil, even though it transfers significantly more money to Russia for oil than for gas.

2.1 EU dependence on Russian natural gas

Natural gas plays a critical role in European energy consumption, with the largest producers, historically, having been the Netherlands, Norway, and the UK. British production peaked in 1999 but started to decline sharply from 2004 onwards as British gas fields in the North Sea dried up leaving total UK production now 2/3rds of its highest ever level.12‘Gas Production’, Department for Business, Energy & Industrial Strategy, 29/07/2021, https://bit.ly/3LDZTVH (checked: 31/05/2022). Furthermore, earthquakes related to gas production in the Netherlands have accelerated the decline in gas output of the Groningen gas field, once the largest in Europe.13‘Groningen gas field’, Global Energy Monitor Wiki, 06/11/2021, https://bit.ly/3wxYImq (checked: 31/05/2021). As such, EU’s own net imports have increased by over 49 billion cubic metres (bcm) since 2016,14Calculations made using: ‘Supply, transformation and consumption of gas’, Eurostat, 25/05/2022, https://bit.ly/3ahU9E7 (checked: 31/05/2022). with EU import dependence for gas rising from 70.7% in 2009 to 83.6% in 2020.15‘EU energy mix and import dependency’, Eurostat, 04/03/2022, https://bit.ly/3LAo8Eb (checked: 31/05/2022).

As European production and supply declined, Russia began expanding its gas exports to the EU. By 2009, 12 pipelines delivering natural gas to the EU had been built, with three running directly to Estonia, Finland, and Latvia, four passing through Belarus to Lithuania and Poland, and the remaining five snaking over Ukraine to get to Hungary, Romania, Poland, and Slovakia. An additional pipeline – Nord Stream I – was constructed in 2011 to connect Germany directly to Russia via the Baltic Sea.

Russia is now by far the EU’s largest supplier of natural gas, whether it is to heat homes, generate electricity, or fuel industry. In 2021, the EU imported 155 bcm of Russian gas, the vast majority of which was delivered via these pipelines.16‘REPowerEU: Joint European Action for more affordable, secure and sustainable energy’, European Commission, 08/03/2022, https://bit.ly/3LH0Z2W (checked: 31/05/2022). Importantly, many EU countries have become woefully dependent on Russia for natural gas. Indeed, the EU imports 41.1% of its gas imports from Russia as a bloc, but as Chart 2 shows, 13 out of the EU’s 27 members imported over 50% of their gas from Russia in 2020, with seven of them importing over 75%.17‘Imports from Russia in gross available energy in 2020 (including Eurostat estimates)’ table from dataset downloaded from: ‘EU energy mix and import dependency’, Eurostat, 04/03/2022, https://bit.ly/3LAo8Eb (checked: 31/05/2022). The EU’s own dependency therefore masks the true extent of it if examined from the level of specific EU countries.

Chart 2: EU countries dependent on Russian natural gas

Merkel’s decision to push ahead with the Nord Stream II pipeline would have increased Germany’s dependency. Had this project – a second pipeline with a 55 bcm per year capacity built between 2011 and 2021 running parallel to Nord Stream I in the Baltic Sea – been approved, the two Nord Stream pipelines would have provided approximately 130% of Germany’s annual natural gas needs.19Calculation made using ‘Gas consumption – bcm’ table from: ‘Statistical Review of World Energy’, BP, 08/07/2021, https://on.bp.com/3M903EB (checked: 31/05/2022).

Moreover, by increasing Russia’s ability to deliver gas directly to Germany and Western Europe, this project would have had geopolitical consequences, effectively decoupling Germany from its eastern neighbours, diminishing Ukraine’s significance as a transit country, and strengthening Russia’s hand in negotiating energy prices with the Ukrainian authorities.20Anne-Sophie Corbeau, ‘Scenarios of Reduced Russian Gas Flow to Europe’, Centre on Global Energy Policy, 11/03/2022, https://bit.ly/3sQQxzb (checked: 31/05/2022). Obviously, Nord Stream II has caused controversy and the US has pressured Germany and the EU into cancelling the project: former President Donald Trump was particularly vocal about the issue, warning that the Nord Stream II project would effectively turn Germany into a ‘hostage of Russia.’21‘Nord Stream 2 Pipeline, Russia and Germany’, Offshore Technology, 01/03/2022, https://bit.ly/3sOTfVY (checked: 31/05/2022). More recently, the UK has drawn attention to the problematic nature of the EU-Russia energy relationship, especially as intelligence revealed during autumn 2021 that the Kremlin was going to renew its offensive against Ukraine.22See footnote 11.

Russia’s military operations since February 2022 prompted further calls for action to be taken against imports of Russian gas. Germany’s Federal Government declined to grant Nord Stream II an operating licence as a ‘purely commercial project’, thereby putting the pipeline in limbo.23Merkel’s spokesperson quoted in: Stephen F. Szabo, ‘Germany’s Aussenpolitik After the Election’, Eric Langenbacher (ed.), Twilight of the Merkel Era: Power and Politics in Germany after the 2017 Bundestag Election (New York City: Berghahn Books, 2019), p. 281. The US Congress passed a ban on Russian gas imports in March 2022, and EU members have pledged to reduce their consumption of Russian gas by 2/3rds come the end of 2022 through the REPowerEU plan.24‘FACT SHEET: United States Bans Imports of Russian Oil, Liquefied Natural Gas, and Coal’, The White House, 08/03/2022, https://bit.ly/3ySckKD (checked: 31/05/2022); ‘REPowerEU Plan’, European Commission, 18/05/2022, https://bit.ly/3NyIpeR (checked: 31/05/2022); Frédéric Simon and Kira Taylor, ‘EU tables €300bn plan to ditch Russian fossil fuels, speed up green transition’, Euractiv, 18/05/2022, https://bit.ly/38JQpdZ (checked: 31/05/2022). Of course, European countries have different views on a Russian gas boycott, with Germany, Italy, and Hungary being the most hesitant. For Germany alone, an immediate boycott could entail a slump in GDP of between 2% and 5% in 2022.25‘Monthly Report: April 2022’, Deutsche Bundesbank, 10/05/2022, pp. 22-25, https://bit.ly/39JEZXO (checked: 31/05/2022). Unsurprisingly this has been a source of some friction within EU ranks, not least because other EU countries are prepared to move more quickly and gas revenue provides the Kremlin with the means to attack Ukraine. Sales of Russian gas from the EU amounted to about €59.5 million a day in 2021, a figure which has grown significantly in 2022 due to spiking gas prices.26Calculations made using: ‘EU Trade since 1999 by SITC’, Eurostat Comext, 16/05/2022, https://bit.ly/3x5lYZn (checked: 31/05/2022).

2.2 EU dependence on Russian oil

Europe also imports a large quantity of oil from Russia. The EU’s dependence on Russia for gas is greater than it is for oil, but the value of oil the EU imports is far larger. In 2021, the EU imported €70.8 billion of oil from Russia.27Ibid. In 2021, the Netherlands paid Russia around €16.2 billion for oil, buying around 740,000 barrels per day (b/d) and Germany paid Russia around €11.7 billion for oil and bought around 570,000 b/d.28Ibid. Poland bought about €7.5 billion and imported around 350,000 b/d, and Finland bought about €3.5 billion, importing around 160,000 b/d.29Ibid. As Chart 3 shows, out of the EU’s 27 members, eight were found to import over 50% of their oil from Russia.30‘Imports from Russia in gross available energy in 2020 (including Eurostat estimates)’ table from dataset downloaded from: ‘EU energy mix and import dependency’, Eurostat, 04/03/2022, https://bit.ly/3LAo8Eb (checked: 31/05/2022). Countries found along the Druzhba pipeline running through Ukraine and Belarus were found to import especially large sums of Russian oil.

Chart 3: EU Countries dependence on Russian oil

If the EU-Russian oil trade were to stop, around 3.25 million b/d of Russian oil would be taken out of the market, severely impacting global supply and oil price volatility.32Calculations made using: ‘EU Trade since 1999 by SITC’, Eurostat Comext, 16/05/2022, https://bit.ly/3x5lYZn (checked: 31/05/2022). The Organisation of Petroleum Exporting Companies (OPEC) has resisted calls for increasing its output to steady global prices, citing its (obvious) lack of responsibility for the Russian actions that have led to price volatility and uncertainties in future Chinese demand due to its zero Covid-19 policy.33‘28th OPEC and non-OPEC Ministerial Meeting’, Organisation of the Petroleum Exporting Countries, 05/05/2022, https://bit.ly/3NOwklB (checked: 31/05/2022). Further complicating the matter around an EU ban is the fact that many EU refineries are optimised for Russian oil, particularly ones in large consumers such as Germany and Poland.34As Mark Rutte, Prime Minister of the Netherlands, admitted in March 2022: ‘[t]oo many refineries in the eastern and western part of Europe still completely depend on Russian oil and with gas it’s even worse.’ See: ‘EU too dependent on Russian oil and gas to cut it off tomorrow -Dutch PM’, Reuters, 21/03/2022, https://reut.rs/38U1hq5 (checked: 31/05/2022).

Due to these constraints, the EU is yet to fully embargo Russian oil products. On 30th May 2022, though, it agreed to a ‘political deal’ to allow the imposition of sanctions on Russian oil imports that will, according to Ursula von der Leyen, President of the European Commission, ‘effectively cut around 90% of oil imports from Russia to the EU by the end of the year.’35Ursula von der Leyen, Twitter, 30/05/2022, https://bit.ly/3ayPpdt (checked: 31/05/2022). This deal, however, is not as comprehensive as some would like as a result of Hungary’s resistance to a blanket-ban. Indeed, it placates the fears of certain countries – such as Hungary and Czechia – of a complete decoupling by allowing pipeline oil imports from Russia to temporarily continue. The Druzhba pipeline’s southern line will continue to operate but will be closed as soon as feasible, though Germany and Poland have pledged to a de facto halt in the northern line’s operations.

The US banned Russian oil imports in March 2022 and the UK has pledged to do the same by 2023. In the short-term, it seems Russia will continue to export oil to the EU; in 2021, it exported about €194 million a day, a cost which may be maintained despite falling volumes of imports due to market price volatility.36Calculations made using: ‘EU Trade since 1999 by SITC’, Eurostat Comext, 16/05/2022, https://bit.ly/3x5lYZn (checked: 31/05/2022). And even if the EU manages to cut Russian oil by 90%, it will still provide Russia with approximately €19.4 million per day in revenue, or just over €7 billion per year.37Ibid.

2.3 EU dependence on Russian coal

Although EU coal imports from Russia are nothing compared to those for oil and gas, they are still substantial. Since the 1992 Rio Earth Summit, the EU has reduced its coal consumption for energy by nearly 55%.38Calculations made using: ‘Supply, transformation and consumption of solid fossil fuels’, Eurostat, 25/05/2022, https://bit.ly/38XoNlK (checked: 31/05/2022). At the same time, however, it has become more dependent on imports, particularly hard coal, as domestic production slowed down.39Ibid. As it sought new markets to fill this widening gap, the EU looked to Russia. As a result, over the past 20 years, total EU coal imports from Russia have grown from 16.9 million tonnes at €709 million per year to 52.1 million tonnes at €5.5 billion per year. Coal still accounts for just over 10% of the EU’s electricity mix and among EU countries in 2021, the Netherlands imported the largest quantity of coal from Russia at 14.7 million tonnes for €1.4 billion, followed by Germany with 8.7 million tonnes for €996 million.40Ibid. Poland was also a large importer of Russian coal in 2021, importing 8.3 million tonnes for €668 million.41Ibid. As Chart 4 shows, six out of the EU’s 27 members import over 50% of their coal from Russia.42‘Imports from Russia in gross available energy in 2020 (including Eurostat estimates)’ table from dataset downloaded from: ‘EU energy mix and import dependency’, Eurostat, 04/03/2022, https://bit.ly/3LAo8Eb (checked: 31/05/2022).

Chart 4: EU countries dependent on Russian coal

Unlike natural gas and oil, the EU is better able to adjust its energy mix to exclude Russian coal. In terms of generating electricity, the EU may still need coal in the short- to mid-term if it is to take decisive action against Russian oil and gas. Those two imports, more so than coal, are what currently finance the Kremlin’s aggressive posture and give Russia undue leverage over the EU and its members. Some extra 140 terawatt-hours of electricity could be produced, for example, if Germany were to ramp up the capacity of its hard coal power plants.44Ibid. Any shortfalls could be met by other large coal producers such as the US, Australia, Indonesia, South Africa, Colombia and Mozambique, which major EU coal importers have displayed a willingness to embrace.45‘Pressemitteilung 3/2022’ [‘Press release 03/2022’], Verein der Kohlenimporteure [Association of Coal Importers], 08/04/2022, https://bit.ly/3GCcA2g (checked: 31/05/2022). Furthermore, there are approximately 2.6 million tonnes of coal stocked in EU ports that would cover about three weeks of Russian imports in the case of a supply emergency.46Ben McWilliams, Giovanni Sgaravatti, Simone Tagliapietra and Georg Zachmann, ‘Can Europe manage if Russian oil and coal are cut off?’, Bruegel, 17/03/2022, https://bit.ly/387lzf5 (checked: 31/05/2022).

Consequently, the EU has agreed on an import ban on all forms of Russian coal, similarly to the UK and US. This ban will become fully effective from the second week of August 2022. Any new contracts for Russian coal were banned after the 8th April 2022, when these sanctions were published in the EU’s official journal.47‘Council Regulation (EU) 2022/576 of 8 April 2022 amending Regulation (EU) No 833/2014 concerning restrictive measures in view of Russia’s actions destabilising the situation in Ukraine’, Official Journal of the European Union, 08/04/2022, https://bit.ly/3yTWFuu (checked: 31/05/2022). Existing contracts will thus have to be terminated by the second week of August 2022. Russia will be able to receive payments from the EU on coal exports until then, but these actions will ultimately reduce Russia’s revenue to the tune of approximately €15 million per day, or €5.5 billion per year.48Calculations made using: ‘EU Trade since 1999 by SITC’, Eurostat Comext, 16/05/2022, https://bit.ly/3x5lYZn (checked: 31/05/2022).

3.0 A new EU energy security strategy

The EU has been preoccupied by managing its transition to a greener economy for several years. In 2019, the European Council made carbon neutrality one of its priorities for its next five-year strategic agenda, with all EU members – except Poland – pledging to achieve carbon neutrality by 2050. Shortly thereafter, discussion of a European Green Deal gathered momentum since it provides the framework for new legislation in relation to the so-called ‘circular economy’, biodiversity, agriculture, food systems, and energy innovation. In response, the EU agreed to the ‘Fit for 55’ package, which consists of proposals for amending and proposing EU legislation in view of meeting various climate goals such that gas consumption and net greenhouse gas emissions would fall by at least 30% and 55% by 2030, respectively.49‘REPowerEU: A plan to rapidly reduce dependence on Russian fossil fuels and fast forward the green transition,’ European Commission, 18/05/2022, https://bit.ly/3LH0Z2W (checked: 31/05/2022). Those proposals specifically touched on the design of an emissions trading system, the setting of binding emissions targets, energy efficiency, emissions standards for vehicles, alternative fuels infrastructure, and so on. The underlying principle for all of these efforts was to mitigate the effects of climate change. A reduced dependency on Russia was not the explicit goal, but it would be the fortunate by-product.50‘Fit for 55 – The EU’s Plan for a Green Transition’, European Council, 31/03/2022, https://bit.ly/3aa2g5v (checked: 31/05/2022).

The EU realised, however, that Russia’s renewed offensive against Ukraine brought its energy policies into sharp relief; its mission to reduce emissions now combined with a geopolitical imperative. The EU therefore pledged that it would, in the words of REPowerEU, go ‘about rapidly reducing our dependence on Russian fossil fuels by fast forwarding the clean transition and joining forces to achieve a more resilient energy system and a true Energy Union.’51‘REPowerEU Plan’, European Commission, 18/05/2022, https://bit.ly/3NyIpeR (checked: 31/05/2022). Presented by the European Commission on 18th May 2022, REPowerEU seeks at once to enhance EU energy sovereignty by reducing dependency on Russia, while also tackling the climate crisis. It thus strives to accelerate the EU’s transformation into a low-carbon economy by building upon Fit for 55.

In addressing how the EU can phase out Russian gas by 2027, REPowerEU calls for making energy savings via high efficiency heating systems, diversifying energy imports (through, for example, greater use of Liquid Natural Gas (LNG)), accelerating the clean energy transition by way of investing in solar, wind, and heat pump technologies as well as hydrogen production, and more reforms and investment to help cushion the disruptions that may ensue during this transition.52Ibid. The EU is trying to hasten the green transition to match the equivalent of 155 bcm imports of Russian gas with additional renewable capacity, including carbon-neutral biomethane, gas diversification, and front-loaded energy savings.53‘REPowerEU: Joint European Action for more affordable, secure and sustainable energy’, European Commission, 08/03/2022, https://bit.ly/3LH0Z2W (checked: 31/05/2022).

Yet while these objectives are laudable and strategically sensible, the EU’s energy ambitions will have to overcome three key challenges:

- Differing levels of willpower: Much depends on the attitudes and policies of EU countries themselves insofar as it is up to them to implement EU measures that enable an orderly phasing out of Russian fossil fuels and a transition to more sustainable and sovereign energy sources. These measures include: public awareness campaigns that encourage public transportation use as well as voluntary reductions in energy consumption; strengthen energy requirements for buildings; and remove regulatory inefficiencies that slow down the granting of permits regarding the development of solar and wind energy infrastructure.54Ben McWilliams, Giovanni Sgaravatti, Simone Tagliapietra and Georg Zachmann, ‘Can Europe manage if Russian oil and coal are cut off?’, Bruegel, 17/03/2022, https://bit.ly/387lzf5 (checked: 31/05/2022). Some countries might be more adept than others in adopting these measures, and so, in playing a coordinating role, the EU may encounter problems as it encourages or shames stragglers into following the lead and best practices of pioneers.55Ibid.

- Political resistance: Though the building of new green or more efficient energy infrastructure is usually a net gain for adopters in terms of environmental hygiene and cost over the longer term, it can have significant up-front costs which can result in political resistance. Equally, the adoption of new greener energy systems can cause other forms of ecological damage which can have political consequences, as in the case of wind turbines and their negative impact on local biodiversity.56Tanja M. Straka, Marcus Fritze and Christian C. Voigt, ‘The human dimensions of a green-green-dilemma: Lessons learned from the wind energy – wildlife conflict in Germany’, Energy Reports, 6 (2020). In the case of weaning itself off Russia, if the EU diversifies away from Russian gas by expanding production of oil and gas from other sources or by increasing coal usage, then carbon-neutrality will remain elusive or may even become harder to achieve, with all the political implications, particularly in countries with influential green parties. Finally, delaying efforts to phase out nuclear power or even to re-activate nuclear plants in some EU countries (such as Germany), may reignite public fears about nuclear energy and lead to a broader political backlash against the necessary measures the EU needs to take to wean itself off Russian energy.

- Adjustment costs: Insofar as the costs of the adjustment are going to be very high, EU countries will inevitably vary in how much they are willing to bear. Some are so unsettled by Russia that they are going to accept those costs in order to achieve the energy security that they now covet. Others might be shocked by Russian behaviour so as to make these sorts of pledges in the near-term, but over time they might become hesitant to follow through because the adjustment in terms of disruption is too painful. The result is for there to be greater fracture within the ranks of the EU. For Russia, this sort of division would be of benefit: that lack of willpower could ensure the viability of its own presence in the European energy market. It could thus stand to continue profiting at Europe’s expense.

The EU is of course responsible for its own energy policy, but given the extent of the challenge it faces, it may need the assistance of close partners to help it change tack. Though the UK and US have long pointed to the risks the EU has been taking in seeing its relationship with Russia through a commercial lens, others may be better-placed to help the EU diversify its energy supplies and embrace a more clear-eyed approach towards Russia.

4.0 Ukraine’s potential as an EU energy partner

Overlooked in current debate on EU energy security is the role that Ukraine can play. After all, both the EU and Ukraine share common goals: they wish to end their dependence on Russian energy sources, reduce the Kremlin’s influence in Eastern Europe and the Black Sea region, and accelerate measures to address climate change. So aligned is Ukraine with the EU that Petro Poroshenko, while President of Ukraine, issued a constitutional amendment to commit his country to join the bloc (as well as the North Atlantic Treaty Organisation (NATO)), while Volodymyr Zelenskyy, the current president, initiated the first stage of the country’s membership application to the EU in April 2022.

The problem, of course, is that Ukraine has been forced to defend itself in high-intensity combat operations aimed at defeating Russia’s war of conquest since at least 24th February 2022. Further, it was compelled to adapt to the Kremlin’s annexation of Crimea and eight-year long campaign of destabilisation in the Donbas region. Not only has Russia’s military aggression destroyed Ukrainian infrastructure, but it has also been calamitous for Ukraine’s environment, not least because of the sheer amounts of fuel burned in the fighting as well as the physical destruction inflicted by Russian forces.57Dmytro Averin, Freek van der Vet, Iryna Nikolaieva, and Nickolai Denisov, ‘The Environmental Cost of the War in Ukraine’, Green European Journal, 06/04/2022, https://bit.ly/3aiy7kD (checked: 31/05/2022); Francisco Martinezcuello, ‘Ukraine Is Ground Zero for the Environmental Impacts of War’, Sierra, 11/04/2022, https://bit.ly/3lCJNRH (checked: 31/05/2022). The cost for Ukraine’s energy security has also been tremendous: Russia captured the Zaporizhzhia Nuclear Power Plant, the biggest of its kind in Europe, so as to strengthen its leverage over Ukraine.58‘Update 67 – IAEA Director General Statement on Situation in Ukraine’, International Atomic Energy Agency, 29/04/2022, https://bit.ly/3NrLpJV (checked: 31/05/2022). When fully operational, the Zaporizhzhia plant generates 20% of Ukraine’s total electricity, a significant sum.59‘Khmelnytskyi Nuclear Power Plant, Ukraine’, Power Technology, 02/03/2022, https://bit.ly/3xcXFc5 (checked: 31/05/2022).

To claim that Ukraine can advance European energy security when it faces such immense challenges, therefore, seems counterintuitive. Such thinking, however, is short-sighted and anti-strategic. A large and resource-rich country, Ukraine is, for the following reasons, well-positioned to become a reliable partner for the EU with respect to its energy supply:

- Large energy production potential: According to the International Energy Agency, ‘Ukraine has substantial renewable energy potential, including significant biomass resources and waste management possibilities, which remains largely untapped’.60‘Ukraine energy profile’, International Energy Agency, 04/2020, https://bit.ly/3MDXxHz (checked: 31/05/2022). Indeed, Ukraine also has abundant natural resources and if investment in this potential is increased – particularly in wind and solar capabilities – its renewable energy output could increase by some 6-8 gigawatts, or 21.4 terawatt hours, by 2030.61Calculations provided by DTEK. This extra production could decrease European gas use by 3.7 bcm a year.62Converted using the International Energy Agency’s conversation rate in: ‘A 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas’, International Energy Agency, 03/03/2022, https://bit.ly/3NIX8Uv (checked: 31/05/2022). Indeed, Ukraine’s renewable energy output could grow by as much as 30 gigawatts by 2030.63Calculations provided by DTEK. This, however, will require greater cross border electricity connectivity between the European Network of Transmission System Operators for Electricity (ENTSO-E) and Ukraine, as well as the implementation of the EU’s hydrogen strategy.64‘Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions’, European Commission, https://bit.ly/3xpXPwu (checked 31/05/2022). Ukraine also has actual potential to substitute 1 bcm – with this figure sometimes cited as high as 9.7 bcm – of Europe’s gas consumption per year through carbon neutral biomethane production; allied to some of the largest gas transportation systems in the world, Ukraine has an edge in shipping biomethane to the EU.65Георгій Гелетуха [George Geletukha], ‘Біометан і зелений водень: порівняємо основні відновлювані гази’ [‘Biomethane and hydrogen hydrogen: compare the main renewable gases’], Green Deal, 28/01/2022, https://bit.ly/3abIM0q (checked 31/05/2022) and ‘Key indicators for gas transportation of the Gas TSO of Ukraine (GTSOU) in 2021’, Transmission System Operator of Ukraine, 06/01/2022, https://bit.ly/3x3RTIe (checked 31/05/2022). Furthermore, Ukraine holds gas reserves of approximately 1.1 trillion cubic metres, the second largest in Europe.66Calculation made using ‘Natural Gas – Total proved reserves’ table from: ‘Statistical Review of World Energy’, British Petroleum, 08/07/2021, https://on.bp.com/3M903EB (checked: 31/05/2022). For comparison, the UK – with around 187 bcm of gas – has the third largest reserves in Europe, amounting to roughly 17% of Ukraine’s reserves.67Ibid. This underpins the sheer scale of Ukraine’s reserves and capacity to bolster the EU’s energy security if they can be properly harnessed. Indeed, while still being able to satisfy its domestic demand, Ukraine’s existing gas extraction plans will allow it to become a net exporter of gas by 2027.68Calculations provided by DTEK.

- Sizeable energy storage capacity: With 30.9 bcm of gas storage capacity, Ukraine holds the equivalent of 27% of the EU’s total (113.7 bcm).69‘Ukraine energy profile’, International Energy Agency, 04/2020, https://bit.ly/3MDXxHz (checked: 31/05/2022) and ‘EU gas storage and LNG capacity as responses to the war in Ukraine’, European Parliament, 29/04/2022, https://bit.ly/3x5U2Ep (checked: 31/05/2022). Storing gas – including hydrogen – in large quantities to enhance energy security will become an ever more pressing issue for EU countries as rising geopolitical tensions disrupt supply lines and as hydrogen becomes, potentially, a means to store energy accumulated through wind and solar power generation.

- Well integrated with European partners: Ukraine now maintains an electrical grid connection with ENTSO-E. Owned by the Government of Ukraine, the Ukrainian transmission system operator (TSO) – Ukrenergo – exclusively operates all of the country’s high-voltage transmission lines. For much of Ukraine’s independent history, the Ukrainian grid was largely connected with the Russian-controlled Integrated Power System, a wide area synchronous transmission grid that is plugged into the Unified Power System of Russia and involves the national networks of Azerbaijan, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Mongolia, and Tajikistan. However, Russia’s aggression in 2014 incited Ukraine to reconfigure its grid connection. In 2017, the EU and Ukraine concluded an agreement to synchronise the entirety of the Ukrainian power grid with the Continental Europe Synchronous Area by 2026.70‘Ukrenergo: Integration of the Ukrainian power grid into the Continental Europe Synchronous Area (CESA)’, European Commission, undated, https://bit.ly/3GnXpKh (checked: 31/05/2022). Russia’s renewed offensive against Ukraine in February 2022 accelerated this process such that Ukraine – along with Moldova – was finally connected to the European grid on 16th March 2022. So far, Ukraine only imports electricity because it lacks static synchronous compensators that improve power stability. Still, this connectivity holds the promise of deepening market integration and could positively impact market competitiveness. It will also aid in Ukraine’s future development and improve existing transfer capacities (see 5.1.2.5).

- Like-minded on climate change: Ukraine has a green agenda that complements that of the EU by way of its commitments to the Paris Agreement, the UN Sustainable Development Goals 2030, and Articles 360-370 of the EU-Ukraine Association Agreement. In some respects, Ukraine’s economy has been ‘greening’ since independence, for its greenhouse emissions have fallen by over 2/3rds, despite Gross National Income per capita increasing by 135% between 1990 and 2020.71‘CO2 emissions (Metric Tons Per Capita) – Ukraine’, World Bank, undated, https://bit.ly/3GbxtRD (checked: 31/05/2022). Calculations made from: ‘GNI per capita, Atlas method (current US$) – Ukraine’, World Bank, undated, https://bit.ly/3Pvj8nD (checked: 31/05/2022). On a per capita basis, in 2019, Ukraine’s CO2 emissions are approximately half of those of Germany and just over 1/3rd of those of the US.72‘CO2 Emissions (Metric Tons Per Capita)’, World Bank, undated, https://bit.ly/3wKN46D (checked: 31/05/2022). That said, much of this net drop in greenhouse emissions has been the result of the massive economic change that attended the post-communist transition, one which saw many polluting but unprofitable industrial enterprises fold. Still, Ukraine’s industrial and agricultural sectors are in sore need of modernisation and remain highly energy – and carbon – intensive relative to those in the EU.73Kseniia Alekankina and Yana Tkachenko, ‘Green Deal In The EU And Ukraine: What Challenges Arise’, Vox Ukraine, 30/07/2021, https://bit.ly/3wE0u5D (checked: 31/05/2022); and Natalia Vasylieva and Svitlana Sytnyk, ‘Agricultural Greenhouse Gas Emissions: Ukrainian Involvement in the Global Ecological Challenge’, Environmental Research, Engineering and Management, 75:3 (2019), pp. 21-32, https://bit.ly/3NbP6Un (checked 31/05/2022). Public funds for climate-friendly projects and policies are lacking and the national priority, in peacetime, is economic growth so as to improve living standards. Mindful of these challenges, Ukraine announced in its National Economic Strategy that it will aim for carbon-neutrality by 2060.74‘Про затвердження Національної економічної стратегії на період до 2030 року’ [‘On approval of the National Economic Strategy for the period up to 2030’], Кабінет Міністрів України [Cabinet of Ministers of Ukraine], 03/03/2022, https://bit.ly/3LDWkyS (checked: 31/05/2022). It also plans on introducing a national greenhouse gas emissions trading system as well as carbon taxes in 2025.75‘Ukraine intends to create a GHG emissions trading scheme in 2025’, Enerdata, 26/01/2022, https://bit.ly/3airVJt (checked: 31/05/2022).

Given the EU’s desire to wean itself off Russian energy imports, a deeper partnership with Ukraine would prove invaluable because of Ukraine’s energy resources and production and storage potential, as well as a meeting of minds in relation to combating climate change. For Ukraine to become a reliable and strong energy partner of the EU, however, steps must be taken to adjust Ukraine’s own regulatory and policy frameworks. These measures may be difficult to undertake, but the long-term benefit for energy security is significant for the EU and Ukraine alike.

5.0 Conclusion

The Kremlin’s renewed assault on Ukraine confirmed the deficiency of EU energy policy over the past thirty years. The policy has failed to deliver the security it was intended to provide, even if it has, to some extent, reduced greenhouse gas emissions which might otherwise have been produced if EU countries had continued to burn coal to generate electrical power. EU countries’ procurement of Russian fossil fuels – while uneven – has contributed to empowering Putin’s kleptocratic regime, which has led Russia not only into an increasingly authoritarian direction, but has also provided it with the funds for an aggressive foreign policy. Despite the EU’s formation of a ‘neighbourhood policy’ to promote stability to its east, Russia’s actions in Georgia and especially Ukraine have undermined peace and security in the Black Sea region – with direct implications for the EU itself.76For more on the European Neighbourhood Policy, see: ‘European Neighbourhood Policy: What is it?’, European Commission, undated, https://bit.ly/3x4rjjy (checked: 31/05/2022).

If the EU is to become ‘more geopolitical’ and undercut Russia’s malignant policies in its eastern neighbourhood, the EU’s energy policy ought to be thoroughly revised. Consequently, REPowerEU should be fully implemented and EU countries dependent on Russian oil and gas ought to accelerate their efforts to wean themselves off both. As they do so, they and the EU would also do well to look to Ukraine – an aspiring EU member – to facilitate the transition. Although Ukraine is currently locked into a conflict of the Kremlin’s making, it has inordinate potential once it has pushed – with British, North American and European assistance – Russia out of its territory to emerge as a trusted energy supplier for the continent. Not only has Ukraine behaved as a reliable transit country since the end of the Soviet Union, but it also has large reserves of its own gas, significant nuclear, biomethane and hydrogen potential, and a geographic location ideal for the generation of wind and solar power.

Besides offering Ukraine a membership perspective, the EU would do well to help facilitate Ukraine’s transition towards a stronger and more resilient partner, particularly with regards to energy. This transition would require significant reforms not only to the EU’s own energy policy, but also to the Ukrainian economy. Those reforms would be to both partners’ benefit: they would help the EU undercut the Kremlin’s power by weaning itself off Russian energy exports, while simultaneously strengthening Ukraine and the EU-Ukrainian relationship. They would also be in the interest of the UK and US as the nuclear underwriters of NATO.

5.1 Policy Recommendations

Undoubtedly, the EU will only reduce its energy dependency on Russian supplies if it follows through with its newfound mission and if the largest and most powerful EU countries – particularly Germany – do not attempt to derail with national agendas the emergence of a fundamentally European approach blending economic and geostrategic elements in a mutually reinforcing way. At the same time, though, Ukraine can also take steps, which the EU can actively support, to make itself more attractive as an EU partner to maximise its potential as an energy supplier. Consequently, the Government of Ukraine would do well to undertake a ream of reforms to the Ukrainian energy sector. These reforms ought to focus on affordability, the security of supply, and sustainability:

5.1.1 Affordability

5.1.1.1 Fully integrate the Ukrainian energy sector with the EU

In terms of implementing the EU energy acquis,77For more on the acquis, see: ‘Energy Community acquis’, undated, Energy Community https://bit.ly/3GBZrGJ (checked: 31/05/2022). Ukraine is progressing too slowly. According to the latest report of the Energy Community Secretariat – an international organisation established to bring together the EU and its neighbours to create an integrated pan-European energy market – Ukraine has implemented aspects of the EU Third Energy Package into little over half (51%) of its electricity sector.78‘Ukraine: Annual Implementation Report’, Energy Community, 01/11/2021, https://bit.ly/3G7IvYe (checked: 31/05/2022). Besides, the Third Energy Package is also outdated, as the EU adopted a next generation energy package – Clean Energy Package (CEP) – in 2019. The Ukrainian Government would therefore do well to speed up the implementation of the EU energy acquis. It should establish more ambitious implementation targets rather than limiting itself to the timeframes and scopes set by the Energy Community.

Day Ahead and Intraday electricity market coupling between Ukraine and EU requires implementing an array of EU guidelines and network codes, specifically the Capacity Allocation and Congestion Management Guideline (CACM GL), which stipulates price market coupling, effectively making two markets operate as one in terms of price. The expected impact of such coupling would be price convergence between the EU and Ukraine. It should ease price hikes in the EU and put a downward pressure on electricity prices in Poland, Slovakia and Hungary in the long run. This also implies that the EU’s electricity market regulator – the Agency for the Cooperation of Energy Regulators (ACER) – would need to take over the final decision making on the coupled markets, which means that regulatory conditions within Ukraine would converge with those in the EU.

In addition, the development of Single Cross Border Capacity Auctions through Forward Capacity Allocation Guidelines (FCA GL) would stimulate cross-border line capacity access. Implementing another EU guideline, FCA GL will unify the rules by which market participants execute cross border trade. This would also simplify exports/imports, increase trade, and increase price convergence between EU countries and Ukraine.

5.1.1.2 Decrease regulatory interference in Ukraine’s electricity market

The Energy Community Secretariat has previously pointed to a significant level of state interference in the Ukrainian electricity market. It stated in its latest Ukraine progress report that:

Bilateral, day-ahead, intraday, balancing and ancillary services markets are operational, but subject to many regulatory interventions. Non-compliant Public Service Obligations (PSO) and regulated prices of state-owned generation companies are impeding competition. Losses are procured by the transmission system operator on the market, but distribution system operators are obliged to buy a significant amount of their losses from state-owned Energoatom in contravention of the acquis.79Ibid.

In response to these issues, Ukraine should find a solution for those current PSO mechanisms and state regulated prices for households that lead to distorted competition on the wholesale market and inaccurate market price indicators. The current gap between the market and household consumer prices under the PSO mechanism is disproportionally large. It also appears that there is currently no regulation that allows for the easing of PSO interference on the market, elevating price competition for state-owned companies.

From the consumer’s point of view, any future PSO phase-out plan in Ukraine should account for the impact that price convergence with the market price will have on the energy poverty of households. The current PSO mechanism should be replaced in the short to mid-term, gradually decreasing market price distortions between those who produce it and those who consume it.

5.1.2 Security of supply

5.1.2.1 Implement a stimulus package for oil and gas extraction

To unlock Ukraine’s gas extraction potential – allowing it to boost domestic production as well as to become a net gas exporter and ultimately a reliable gas supplied to the EU – the Government of Ukraine ought to adopt a wide array of stimulus and support measures.

The lack of predictability and stability in fiscal policy in the gas sector over the last ten years has provoked the withdrawal of foreign investors, particularly Shell and Chevron, from Ukrainian projects. Fiscal changes in 2014-2015 in Ukraine led to a steady decrease in gas production and the dismissal of more than 2,000 industry workers. Overall, a lack of investment in the Ukrainian gas sector has caused a drop in gas production from 18.3 bcm to 13.7 bcm in state-owned companies over the last ten years. Ukraine would do well to stimulate stable fiscal conditions aimed at increasing fossil fuel production that are protected from political change in order to combat these trends and developments.

Among non fiscal-tools, Ukraine should undertake a variety of different measures. It should bolster investment protection, combining this with a more efficient and transparent judicial system. It should develop commodity exchange instruments for trading in the gas market and approve legislation stimulating tight gas and offshore gas production as well as deep drilling. It should ensure the implementation of product sharing agreements, effectively providing support to private investors. It ought also to implement European directives aimed at decarbonisation in the gas sector, provided there is prior consultations with market stakeholders, a sufficient transition period, and no requirement that will put a downward pressure on gas production. In addition, Ukraine should develop new kinds of clean energy that synergise with natural gas (biomethane, hydrogen, and so on); enhance the overall provision of the legislative framework needed for sector development, including the ‘Strategy of Ukrainian Financial Sector Development until 2025’;80‘Strategy of Ukrainian Financial Sector Development until 2025’, National Bank of Ukraine, 29/03/2021, https://bit.ly/3z6TkbD (checked: 31/05/2022). increase government support for studies on carbon capture, utilisation and storage projects in Ukraine; and boost business support for the implementation of environmental, social and governance strategies, such as the United Nations (UN) Sustainable Development Goals.81‘The 17 Goals’, United Nations, undated, https://bit.ly/3M7LEJ3 (checked 31/05/2022).

5.1.2.2 Introduce capacity mechanisms in support of medium and long term electricity supply security

A capacity mechanism is a measure introduced to remunerate capacity resources (such as generators and demand-response or storage units) to ensure the security of energy supply. Capacity mechanisms are usually introduced or maintained if resource adequacy concerns have been identified. According to the Ukrainian TSO’s ‘Generation Adequacy Report’,82‘Звіту з оцінки відповідності (достатності) генеруючих потужностей — 2020’ [‘Conformity assessment report generating capacity – 2020’], Укренерго [Ukrenergo], 2020, PDF document was available on the Ukrainian TSO’s website until the 24th of February 2022 when access to it was removed due to its strategic importance (checked: 31/05/2022). Ukraine’s power system is expected to experience a lack of reserve capacity in the near future. This is due in part to the fact that Ukraine’s renewable energy generation has increased by more than four times in just the past three years.

In 2019, Ukraine liberalised its electricity market according to best European practices – it is now the sole energy market in Ukraine that remunerates producers for the kilowatt hours that they produce and sell.83For one contemporary assessment of this liberalisation, see: Andrian Prokip, ‘Liberalising Ukraine’s Electricity Market: Benefits and Risks’, Wilson Centre, 06/05/2019, https://bit.ly/3t827Gt (checked: 31/05/2022). It does not, however, provide remuneration for reserve capacities, which need consistent financing for their technical maintenance as the energy-only electricity market incorporates only fuel and the running costs of power generation. Reserve capacities are idle most of the time, but may be forced to start at any time if needed by the TSO.

Through the introduction of power mechanisms, EU countries – such as Spain, Portugal, France, Germany, Sweden and Poland – are taking steps to ensure the security of their electricity supply and mitigating against potential blackouts. For its part, Poland – often seen as the prototype for Ukraine’s reforms – initiated a so-called ‘capacity reserve service’ which its TSO could buy from electricity producers.84Aleksandra Komorowska, Pablo Benalcazar, Przemysław Kaszyński and Jacek Kamiński, ‘Economic consequences of a capacity market implementation: The case of Poland’, Energy Policy, 144 (2020). As a result, producers were able to allocate the needed amount of reserve capacities and to calculate the cost of its maintenance. This is, however, a short-term measure which does not address long-term issues. Consequently, Poland is working on the introduction of a more long-term capacity market.85‘Polish Implementation Plan’, Ministry of Climate of Poland, 08/09/2020, https://bit.ly/3LBPVEo (checked: 31/05/2022).

Ukraine should adopt a similar approach to the one taken in Poland. A long-term capacity market will allow for not only the maintenance of existing reserve power units, but also create conditions for the construction of new capacities. Long-term capacity market contracts for 15-20 years would facilitate loan financing for new construction projects. This is of great importance as Ukraine’s thermal and nuclear generation fleet is 70-90% worn out. Thermal capacities – coal and gas – need to be replaced with new capacities due to both ageing, and ecological needs.

5.1.2.3 Improve financial instruments to ensure a green energy transition

In 2008, Ukraine initiated a financial support mechanism – Feed-in Tariffs (FiT) – to stimulate the development of renewable energy.86Andrian Prokip, ‘Ukraine’s Energy Goes Green, but Costs Matter’, Wilson Centre, 30/04/2018, https://bit.ly/3sRx29S (checked: 31/05/2022). The tariff guarantees a fixed US dollar selling price for any renewable capacities until 2030. Since the electricity market was liberalised in 2019, Ukraine has been immersed in public and political discussion regarding the need for renewable energy producers to fulfil further legal obligations according to FiT.

Due to immature and imperfect market mechanisms, however, the Ukrainian electricity market has unfortunately found itself unable to fully pay renewable energy producers, leading to somewhat of a financial crisis. Several international renewable energy investors made court filings against the Ukrainian Government as a result.87‘Ukraine’s largest private power producer threatens legal action over green energy dues’, Reuters, 17/11/2021, https://reut.rs/3zfA8bF (checked: 31/05/2022).

With the help and moderation of the Energy Community Secretariat, renewable energy producers and the Ukrainian Government have been able to agree on the need to stop granting FiT to new renewable energy systems, instead placing them in renewable energy auctions in exchange for the complete fulfilment of previously granted FiT on already existing renewable energy generation sites.

Ukraine should continue with its green transition and fulfil its existing FiT obligations. It should also introduce green auctions for new renewable capacities from 2022, something that is already legally approved and adopted in some cases.

5.1.2.4 Reform the coal sector

As a contracting party to the Energy Community, Ukraine adopted the ‘National Emission Reduction Plan’ (NERP) in 2017 to reduce harmful emissions from existing coal power plants. The plan intends to decrease sulphur oxide emissions by 2028 and nitrogen oxide emissions by 2032, either through the installation of filtration equipment at existing power stations or shutting them down after a certain operational time (20,000-40,000 hours).88For an overview, see: David Saha, Manuel von Mettenheim, Frank Meissner, Clemens Stiewe, and Georg Zachmann, ‘Implementing the National Emissions Reduction Plan (NERP): How should Ukraine’s power plant park look like in 2033?’, Low Carbon Ukraine, 22/09/2021, https://bit.ly/3yTdwhc (checked: 31/05/2022).

The problem is that the total cost to modernise the facilities is estimated to cost about €4.1 billion more than their existing value.89European Business Association estimates, see: ‘Міненерго розробляє новий НПСВ – міністр’ [‘Ministry of Energy is developing a new NPSV – Minister’], Інтерфакс-Україна [Interfax-Ukraine News Agency], 31/08/2021, https://bit.ly/3x2g8rA (checked: 31/05/2022). Furthermore, most will be decommissioned in the 2030s due to old age. For perspective, 10%-20% of existing coal facilities have already been mothballed. Investments in their modernisation will scarcely pay off, yet the premature shutting down of these facilities may lead to blackouts across Ukraine in 2026 – something that cannot be compensated for using additional energy imports due to a lack of connection with ENTSO-E.90Calculation provided by DTEK.

The larger issue lies in the fact that the government does not have sufficient plans to phase out coal power. Further complicating Ukraine’s coal transition is the global consensus that continuing to use coal for power is undesirable. Indeed, a continued reliance on coal is environmentally unfriendly and may undermine Ukraine’s reputation as a responsible stakeholder in the international community.

Accordingly, the NERP should be reformed. Reform should maintain the current emission reduction targets, but propose a different approach and timeline in reaching them, such as through the gradual replacement of old coal power units with new-low carbon capacities. This approach would save billions and bolster Ukraine’s energy security. The capacity market (see 5.1.2.2) should facilitate this transition. Furthermore, the Ukrainian Government should approve a clear and realistic date for ending coal-fueled power generation. This means it ought to approve the ‘Ukraine 2050 Low Emission Development Strategy’ and think critically about the role of thermal generation and coal in Ukraine’s long-term energy plans.91‘Ukraine 2050 Low Emission Development Strategy’, Ministry of Ecology and Natural Resources Ukraine, 14/03/2018, https://bit.ly/38a2KId (checked: 31/05/2022). Finally, the ‘National Programme for the Fair Transformation of Coal Regions’ could be accelerated in cooperation with European partners.92‘Державної цільової програми справедливої трансформації вугільних регіонів України на період до 2030 року’ [‘State Target Program of Fair Transformation of Coal Regions of Ukraine for the Period Until 2030’], Кабінет Міністрів України [Cabinet of Ministers of Ukraine], 22/09/2021, https://bit.ly/3x2CUyv (checked: 31/05/2022). State and private miners will need support during this transformation.

5.1.2.5 Implement smart grids and improve cross-border connectivity

The Ukrainian electricity distribution grid is generally characterised by a high level of loss, increased outage rates, and a low quality of electricity supply. It is ultimately in need of modernisation and refurbishment. The Ukrainian electricity regulator addressed this issue through the implementation of Regulatory Asset Base (RAB) tariffs on Distribution System Operators (DSO). RAB tariffs regulate the tariff system of DSOs and provide much needed investment incentives for DSOs to modernise and refurbish their grids. Further action should be taken here.

Russia’s renewed assault against Ukraine has damaged electricity grids more than any other energy infrastructure. Its repair is of the utmost importance. Yet, this reconstruction effort offers an opportunity for their modernisation and ultimate refurbishment, where EU assistance will be needed.

The EU and Ukrainian Government should encourage the provision of grid repair equipment and spare parts from grid operators, equipment manufacturers, and construction companies in the short-term to ensure the continuous availability of power in Ukraine. In this endeavour, cooperation with government institutions and private companies specialising in modern smart-grids should be encouraged. As they are being repaired and or modernised, know-how and technological solutions should be encouraged from the EU, so as to further the integration of Ukraine’s energy grids with the bloc. The grid rebuilding process should also be facilitated through lending and grants from regional and international financial institutions.

It is also important that the EU and Ukraine strengthen their cooperation in integrating Ukraine into ENTSO-E operations. Deeper electricity market integration between Ukraine and the EU through the development of cross border capacities could increase existing transfer capabilities by up to 10 gigawatts by 2030.93Calculations provided by DTEK. Better access to EU funded financing mechanisms could also allow for Ukraine’s TSO to bring its operations up to EU standards quicker, paving the way for a more stable energy supply and the greater exploitation of Ukraine’s export potential.

5.1.3 Sustainability

5.1.3.1 Boost policy support for the development of new technologies

Storing energy produced through green technologies would revolutionalise Ukraine’s renewables sector. Ukraine should thus boost policy support for the development of these new technologies.

In terms of battery storage, changes should be made to the power market design, such as the removal or relaxation of price caps/floors. A capacity market (5.1.2.2) should also be introduced, as well as a Fast Frequency Reserve, to protect customers and prevent abuse of market power.

Regarding biomethane energy, Ukraine would do well to synchronise verification mechanisms (certification and the guarantees of origin) with the EU to allow for the products export to EU countries. This could involve the adoption of technical regulations which allow for biomethane transportation using Ukraine’s existing – and extensive – gas transmission infrastructure.

Finally, Ukraine should promote its green hydrogen by aligning certification and verification mechanisms with the EU (such as its rules around ‘Renewable Fuels of Non-Biological Origin’ and ‘Guarantees of Origin’ for renewable sources). This would involve the creation of a conducive regulatory framework for the allocation land plots for hydrogen projects; the integration of Ukraine into the goals and objectives of the EU’s REPowerEU plan; and the signing of a strategic partnership with Ukraine on renewable hydrogen in 2022, supported by active engagement from the private sector.

About the authors

Dr Alexander Lanoszka is Assistant Professor in the Department of Political Science at the University of Waterloo, Canada and an Ernest Bevin Associate Fellow in Euro-Atlantic Geopolitics at the Council on Geostrategy. He has previously taught at City, University of London, and was a Postdoctoral Fellow at the Dickey Centre for International Understanding at Dartmouth College, and a Stanton Nuclear Security Postdoctoral Fellow at Massachusetts Institute of Technology’s Security Studies Programme. Dr Lanoszka has worked for the United States Department of Defence and has consulted for Global Affairs Canada. He holds a PhD in Philosophy and an MA in Politics, both from Princeton University.

James Rogers is Co-founder and Director of Research at the Council on Geostrategy, where he specialises in the connections between Euro-Atlantic and Indo-Pacific geopolitics and British strategic policy. Previously, he held positions at the Henry Jackson Society, the Baltic Defence College, and the European Union Institute for Security Studies. He has been invited to give oral evidence at the Foreign Affairs, Defence, and International Development committees in the House of Commons. He holds an MPhil in Contemporary European Studies from the University of Cambridge and an award-winning BSc Econ (Hons) in International Politics and Strategic Studies from the University of Wales, Aberystwyth.

Patrick Triglavcanin is a Research Assistant and Deputy Editor of Britain’s World at the Council on Geostrategy. He holds a BA in Sociolegal Studies from the University of Western Australia and a Postgraduate Diploma in International Relations and National Security (first class) from Curtin University.

Acknowledgments

The Council on Geostrategy is grateful to DTEK for helping to make this study possible.

Disclaimer

This publication should not be considered in any way to constitute advice. It is for knowledge and educational purposes only. The views expressed in this publication are those of the author and do not necessarily reflect the views of the Council on Geostrategy or the views of its Advisory Council. Any conclusions drawn from data included in this publication are the responsibility of the author and not that of the issuing body.

No. GPR01 | ISBN: 978-1-914441-24-0

- 1Boris Johnson, Speech: ‘PM speech to the Lord Mayor’s Banquet’, Prime Minister’s Office, 10 Downing Street, 15/11/2021, https://bit.ly/3ySgB0U (checked: 31/05/2021).

- 2These statistics have been calculated using the Eurostat Comext database. The products have been selected using Standard International Trade Classification Revision 4 and were chosen to best represent those used for energy. They are as follows: SITC 32 (Coal, coke and briquettes), SITC 333 (Petroleum oils from natural gas condensates), SITC 334 (Petroleum oils and oils obtained from bituminous minerals, crude) and SITC 343 (Natural gas, whether or not liquified). ‘Import value’ refers to the overall trade value of a product. See: ‘EU Trade since 1999 by SITC’, Eurostat Comext, 16/05/2022, https://bit.ly/3x5lYZn (checked: 31/05/2022). Further statistics using this database follow the same method of calculation.

- 3Ibid.

- 4Ibid.

- 5‘EU Trade since 1999 by SITC’, Eurostat Comext, 16/05/2022, https://bit.ly/3x5lYZn (checked: 31/05/2022).

- 6See: ‘Mixed responses to US-Germany Nord Stream 2 deal’, DW, 22/07/2021, https://bit.ly/3wYbY2K (checked: 31/05/2022).

- 7Discursive statecraft includes all forms of legitimate narrative projection, as well as illegitimate disinformation and propaganda campaigns. Governments engage in discursive statecraft to change perceptions of countries and ideas at the international level to the extent that the parameters of debate are controlled in accordance with their interests. For more on discursive statecraft, see: ‘Discursive Statecraft’, Council on Geostrategy, No date, https://bit.ly/3m66hul (checked: 31/05/2022).

- 8According to the International Monetary Fund, Russia’s GDP estimate for 2021 was US$1.76 trillion (€1.64 trillion). See: ‘World Economic Outlook’, International Monetary Fund, 19/04/2022, https://bit.ly/3sPCHNy (checked: 31/05/2022). The Russian news agency TASS Russian News Agency reports that Russia’s federal budget for 2022 will be US$315 billion (€294 billion). See: ‘Russia will have budget surplus in 2022 – PM’, TASS Russian News Agency, 07/04/2022, https://bit.ly/38zV4iN (checked: 31/05/2022). The International Institute for Strategic Studies calculates Russia’s defence spending to have been US$62.2 billion (€58.1 billion) in 2021. See: ‘Military Balance 2022 Further assessments’, International Institute for Strategic Studies, 15/02/2022, https://bit.ly/39M3sM4 (checked: 31/05/2022). US Dollars were converted to Euros using Google on 08/06/2022 when US$1 was worth €0.93.

- 9‘EU energy mix and import dependency’, Eurostat, 04/03/2022, https://bit.ly/3LAo8Eb (checked: 31/05/2022).

- 10During Autumn 2021 and Winter 2022, British and American leaders became increasingly outspoken of European dependency on Russian energy. Johnson condemned Nord Stream II in his annual speech to the Lord Mayor’s Banquet in November 2021. Liz Truss also condemned the pipeline in a commentary for the Daily Telegraph in November 2021 and during a speech at Chatham House in 2022. See: Boris Johnson, Speech: ‘PM speech to the Lord Mayor’s Banquet’, Prime Minister’s Office, 10 Downing Street, 15/11/2021, https://bit.ly/3ySgB0U (checked: 31/05/2021); Liz Truss, ‘We must stand together for freedom and democracy’, Daily Telegraph, 13/11/2021, https://bit.ly/3sPgMX4 (checked: 31/05/2022) and Liz Truss, Speech: ‘Building the Network of Liberty’, 08/12/2021, Foreign, Commonwealth and Development Office, https://bit.ly/3sTQZNd (checked: 31/05/2022). Johnson also condemned European energy dependency when he was Foreign Secretary in 2018. See: Patrick Wintour, ‘Boris Johnson joins US in criticising Russia to Germany gas pipeline’, The Guardian, 22/05/2018, https://bit.ly/3PyAIqJ (checked: 31/05/2022).

- 11‘REPowerEU: Joint European Action for more affordable, secure and sustainable energy’, European Commission, 08/03/2022, https://bit.ly/3LH0Z2W (checked: 31/05/2022).

- 12‘Gas Production’, Department for Business, Energy & Industrial Strategy, 29/07/2021, https://bit.ly/3LDZTVH (checked: 31/05/2022).

- 13‘Groningen gas field’, Global Energy Monitor Wiki, 06/11/2021, https://bit.ly/3wxYImq (checked: 31/05/2021).

- 14Calculations made using: ‘Supply, transformation and consumption of gas’, Eurostat, 25/05/2022, https://bit.ly/3ahU9E7 (checked: 31/05/2022).

- 15‘EU energy mix and import dependency’, Eurostat, 04/03/2022, https://bit.ly/3LAo8Eb (checked: 31/05/2022).

- 16‘REPowerEU: Joint European Action for more affordable, secure and sustainable energy’, European Commission, 08/03/2022, https://bit.ly/3LH0Z2W (checked: 31/05/2022).

- 17‘Imports from Russia in gross available energy in 2020 (including Eurostat estimates)’ table from dataset downloaded from: ‘EU energy mix and import dependency’, Eurostat, 04/03/2022, https://bit.ly/3LAo8Eb (checked: 31/05/2022).

- 18A percentage above 100% indicates that the country imports more than it needs for domestic consumption, where it may use the imports to export a different energy product. Ibid.

- 19Calculation made using ‘Gas consumption – bcm’ table from: ‘Statistical Review of World Energy’, BP, 08/07/2021, https://on.bp.com/3M903EB (checked: 31/05/2022).

- 20Anne-Sophie Corbeau, ‘Scenarios of Reduced Russian Gas Flow to Europe’, Centre on Global Energy Policy, 11/03/2022, https://bit.ly/3sQQxzb (checked: 31/05/2022).

- 21‘Nord Stream 2 Pipeline, Russia and Germany’, Offshore Technology, 01/03/2022, https://bit.ly/3sOTfVY (checked: 31/05/2022).

- 22See footnote 11.

- 23Merkel’s spokesperson quoted in: Stephen F. Szabo, ‘Germany’s Aussenpolitik After the Election’, Eric Langenbacher (ed.), Twilight of the Merkel Era: Power and Politics in Germany after the 2017 Bundestag Election (New York City: Berghahn Books, 2019), p. 281.

- 24‘FACT SHEET: United States Bans Imports of Russian Oil, Liquefied Natural Gas, and Coal’, The White House, 08/03/2022, https://bit.ly/3ySckKD (checked: 31/05/2022); ‘REPowerEU Plan’, European Commission, 18/05/2022, https://bit.ly/3NyIpeR (checked: 31/05/2022); Frédéric Simon and Kira Taylor, ‘EU tables €300bn plan to ditch Russian fossil fuels, speed up green transition’, Euractiv, 18/05/2022, https://bit.ly/38JQpdZ (checked: 31/05/2022).

- 25‘Monthly Report: April 2022’, Deutsche Bundesbank, 10/05/2022, pp. 22-25, https://bit.ly/39JEZXO (checked: 31/05/2022).

- 26Calculations made using: ‘EU Trade since 1999 by SITC’, Eurostat Comext, 16/05/2022, https://bit.ly/3x5lYZn (checked: 31/05/2022).

- 27Ibid.

- 28Ibid.

- 29Ibid.

- 30‘Imports from Russia in gross available energy in 2020 (including Eurostat estimates)’ table from dataset downloaded from: ‘EU energy mix and import dependency’, Eurostat, 04/03/2022, https://bit.ly/3LAo8Eb (checked: 31/05/2022).

- 31A percentage above 100% indicates that the country imports more than it needs for domestic consumption, where it may use the imports to export a different energy product. Ibid.

- 32Calculations made using: ‘EU Trade since 1999 by SITC’, Eurostat Comext, 16/05/2022, https://bit.ly/3x5lYZn (checked: 31/05/2022).

- 33‘28th OPEC and non-OPEC Ministerial Meeting’, Organisation of the Petroleum Exporting Countries, 05/05/2022, https://bit.ly/3NOwklB (checked: 31/05/2022).